GST Audit Case Study 1- Non-payment of late fee for delay in Filing of GSTR 1.

GST AUDIT

GST Audit Case Study 1- Non-payment of late fee for delay in Filing of GSTR 1.

GST Audit Case Study 1- Non-payment of late fee for delay in Filing of GSTR 1.

Late fee of GSTR-1 for late filling not auto populating in form GSTR-1 or in GSTR-3B but Currently Notices for late fees for GSTR 1 are being issued as a part of the department GST Audit the notice issued by the department is below.

Aims and objectives of GST Audit

Audit in GST should intend to evaluate the credibility of self-assessed tax liability of a taxpayer based on the twin test of accuracy of their declarations and the accounts maintained by the taxpayer. Thus, Audit in GST should have the following objectives:

- Measurement of compliance levels with reference to compliance strategy of the tax administration.

- Detection of non-compliance and revenue realization

- Prevention of non-compliance in the future.

- Discovering areas of non-compliance to prevent taxpayers from continuing with such deviations from expected compliance behaviour that results in erroneous declaration of self-assessed liability.

- Providing inputs for corrections in/amendments to the legal framework which are being exploited by taxpayers to avoid paying taxes.

- Encouraging voluntary compliance.

- Any other goals deemed worth pursuing by the GST administration.

Audit Para No. 1 - Non-payment of late fee for delay in Filing of GSTR 1.

As per sub-section (1) of Section 37 of the CGST/SGST Act, 2017, Every registered person, other than an Input Service Distributor, a non-resident taxable person and a person paying tax under the provisions of section 10 or section 51 or section 52, shall furnish, electronically, in such form and manner as may be prescribed, the details of outward supplies of goods or services or both effected during a tax period on or before the tenth day of the month succeeding the said tax period and such details shall be communicated to the recipient of the said supplies within such time and in such manner as may be prescribed.

As per sub- rule (1) of Rule 59 of the CGST/SGST Rules, 2017, Every registered person, other than a person referred to in section 14 of the Integrated Goods and Services Tax Act, 2017 (13 of 2017), required to furnish the details of outward supplies of goods or services or both under section 37, shall furnish such details in FORM GSTR-1 for the month or the quarter, as the case may be, electronically through the common portal, either directly or through a Facilitation Centre as may be notified by the Commissioner. On verification of the GSTR-1’s filed by the taxpayer for the period from July-2017 to March-2021, it could be seen that the taxpayer has filed returns in Form GSTR-1 for few months beyond the due dates as shown in the table below.

As per sub- section (1) of section 47 of the CGST/SGST Act, 2017,any registered person who fails to furnish the details of outward or inward supplies required under section 37 or section 38 or returns required under section 39 or section 45 by the due date shall pay a late fee of one hundred rupees for every day during which such failure continues subject to a maximum amount of five thousand rupees. Notification NO. 04/2018-Central Tax dated 23.01.2018, waives the amount of late fee payable by any registered person for failure to furnish the details of outward supplies for any month/quarter in FORM GSTR-1 by the due date under section 47 of the said Act, which is in excess of an amount of twenty-five rupees for every day during which such failure continues.

It is seen from the table below that there are delays during 2019-20 to 21-22 respectively in filing GSTR-1 Returns. Accordingly, the late fee for delay filing of GSTR 1 for 2018-19 to 21-22 works out to be Rs. XXXXX/- [CGST Rs. XXXXX/-and SGST Rs. XXXXX/-].

The late fee of Rs. XXXXX/-(Rs. XXXXX/- each for CGST and SGST). The same may be paid in cash through DRC 03 generated year-wise.

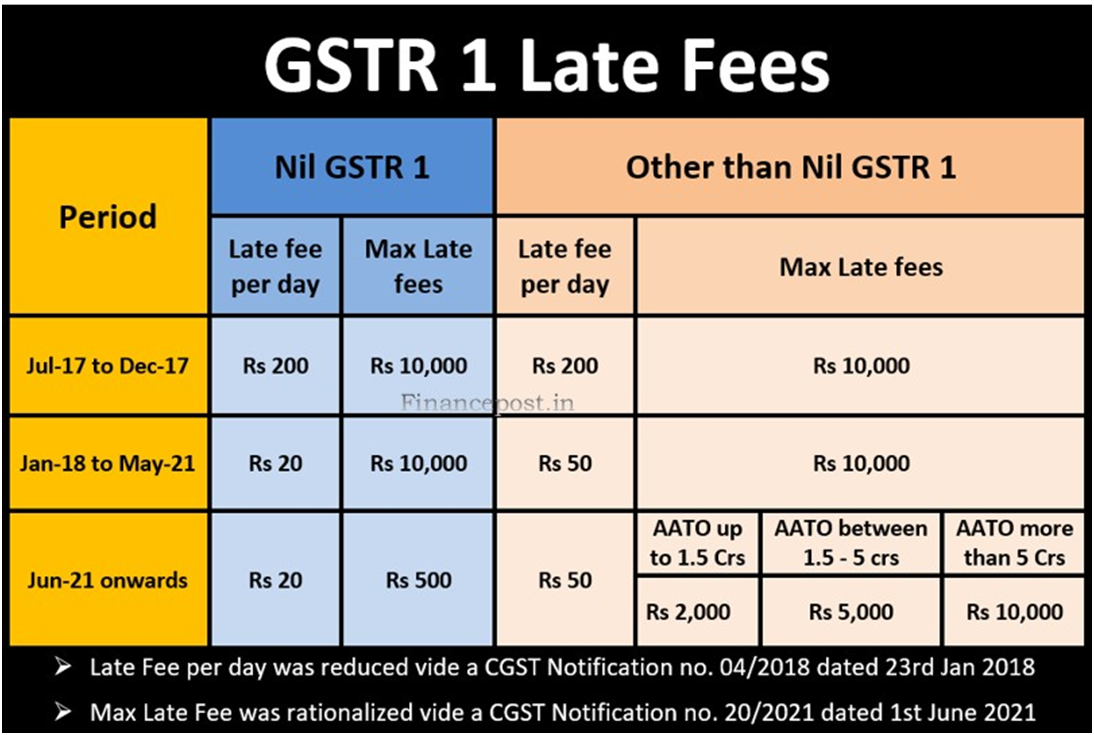

GSTR -1 Late Fees

Late fees for delay in furnishing GSTR 1 neither auto-populate while furnishing the return in Form GSTR 1 nor in Form GSTR 3B. Unlike the late fees for delay in furnishing Form GSTR 3B which is auto-calculated and populates while furnishing the return in Form GSTR 3B.

- Taxpayers who are registered under GST are required to furnish prescribed GST returns within the notified due dates for the tax period. (currently it is 11th day of every succeeding month for regular tax payers )

- Provisions of section 47 are invoked when registered taxpayers fail to furnish the applicable GST returns within the stipulated time frame.

- Provision of section 128 confers the power to the Government to waive or reduce the late fee referred to u/s 47 for mitigating the circumstances based on the recommendations of the Council.

- Delay in furnishing Nil GSTR 1 will also attract late fees u/s 47.

- Late fees is always to be deposited through an electronic cash ledger only. It cannot be set off against the balance in the electronic credit ledger.

Amendment in Section 47

Section 47 was substituted by section 108 of the Finance Act 2022. Substituted section 47 was notified vide CGST Notification no. 18/2022 dated 28th September 2022 to be effective retrospectively from 1st July 2017.

After Amendment from 1st Oct 222

Section 47(1) %u2013 Any registered person who fails to furnish the details of outward supplies required under section 37 or returns required under section 39 or section 45 or section 52 by the due date shall pay a late fee of one hundred rupees for every day during which such failure continues subject to a maximum amount of five thousand rupees.

Before Amendment from 1st Jul 2017 to 30th Sep 2022

Section 47(1) - Any registered person who fails to furnish the details of outward supplies or inward supplies required under section 37 or section 38 or returns required under section 39 or section 45 by the due date shall pay a late fee of one hundred rupees for every day during which such failure continues subject to a maximum amount of five thousand rupees.

Rationalization of late fees for GSTR 1

GST council took the decision in the 43rd GST Council Meeting dated 28th May 2021 to cap the maximum late fees for delay in furnishing the GSTR-1. The government used the powers conferred u/s 128 to notify the maximum late fees for different classes of taxpayers filing GSTR 1 by issuing a CGST Notification no. 20/2021 dated 1st June 2021.

Return |

Late Fees per day |

Maximum Late Fees | |

| Nil GSTR 1 | Rs. 20 per day (SGST CGST) | Irrespective of the turnover | Rs 500 (SGST CGST) |

Other than Nil GSTR 1 |

Rs. 50 per day GST CGST) | If AATO in the preceding year is less than Rs. 1.5 Crores | Rs 2,000 (SGST CGST) |

| If AATO in the preceding year above Rs 1.5 Crores less than Rs. 5 Crores | Rs 5,000 (SGST CGST) | ||

| If AATO in the preceding year is above Rs. 5 Crores | Rs 10,000 (SGST CGST) | ||

Note:

- Rationalized late fees will be applicable for the month of June 2021 and onwards.

- Late Fees for taxpayers having AATO exceeding Rs 5 Crores in the preceding financial year were not rationalized in the 43rd GST Council Meeting. So, the earlier upper cap of Rs. 10,000/- would apply.

Waiver of late fees due to COVID-19 for GSTR 1

Considering the COVID-19 pandemic, the Government used the powers conferred u/s 128 to waive the late fee for all taxpayers if the return of outward supplies in Form GSTR 1 was filed within the prescribed due date. CGST Notification No: 53/2020 dated 24th June 2020.

Period | Late Fees waived if GSTR 1 will be filed up to |

Mar 2020 | 10th Jul 2020 |

Apr 2020 | 24th Jul 2020 |

May 2020 | 28th Jul 2020 |

Jun 2020 | 5th Aug 2020 |

Jan-Mar 2020 | 17th Jul 2020 |

Apr-Jun 2020 | 3rd Aug 2020 |

First GST Amnesty Scheme for GSTR 1

GST council took the decision in the 31st GST council meeting held on 22nd December 2018 to waive off the late fees for non-filers of GST returns for the months of July 2017 to September 2018.

- Return - Form GSTR 1 (Monthly GST Return and Quarterly GST Return)

- Taxpayer - All the registered taxpayers who were required to furnish GSTR 1 monthly/quarterly

- Tax Period for which waiver - July 2017 to September 2018 (15 months)

- Period of Filing - 22nd December 2018 to 31st March 2019.

- Notification - CGST notification no. 75/2018 dated 31st December 2018

Note: The due date of furnishing GSTR 1 was not extended, it was only a waiver from late fees.

Second GST Amnesty Scheme for GSTR 1

GST council took the decision in the 38th GST Council Meeting dated 18th December 2019 to waive off the late fees for non-filers of GST return for the months of July 2017 to November 2019.

- Return - Form GSTR 1 (Monthly GST Return and Quarterly GST Return)

- Taxpayer - All the registered taxpayers who were required to furnish GSTR 1 monthly/quarterly

- Tax Period for which waiver - July 2017 to November 2019 (29 months)

- Period of Filing - 19th December 2019 to 10th January 2020.

- Notification - CGST Notification no 74/2019 dated 26thDecmeber 2019.

- Extended Period of Filing - 19th December 2019 to 17th January 2020.

- Notification for extension - CGST Notification no. 04/2020 dated 10th January 2020

Note: The due date of furnishing GSTR 1 was not extended, it was only a waiver from late fees.

First GST Amnesty Scheme for GSTR 1

GST council took the decision in the 31st GST council meeting held on 22nd December 2018 to waive off the late fees for non-filers of GST returns for the months of July 2017 to September 2018.

- Return - Form GSTR 1 (Monthly GST Return and Quarterly GST Return)

- Taxpayer - All the registered taxpayers who were required to furnish GSTR 1 monthly/quarterly

- Tax Period for which waiver - July 2017 to September 2018 (15 months)

- Period of Filing - 22nd December 2018 to 31st March 2019.

- Notification - CGST notification no. 75/2018 dated 31st December 2018

Note: The due date of furnishing GSTR 1 was not extended, it was only a waiver from late fees.

Reduction of late fees for GSTR 1

Considering the plight of taxpayers, the Government using the powers conferred u/s 128 reduced the late fees per day leviable u/s 47 for the delay in furnishing the GST return in Form GSTR 1 by issuing a CGST Notification no. 4/2018 dated 23rd January 2018

Return | Late Fees |

| Nil GSTR 1 | Rs. 20 per day (SGST CGST) |

| Other than Nil GSTR 1 | Rs. 50 per day (SGST CGST) |

Max late fees can be Rs. 10,000/- (SGST CGST) | |

Author's Suggestion

Most of the taxpayers have not made the payment for the late fees while filing the returns. But as a prudent practice, auditors and taxpayers should voluntarily pay the late fees while filing GSTR 3B for the delay in filing GSTR 1.Other wise department may issue notices later demanding late fees for delay in furnishing the return in Form GSTR-1.

DISCLAIMER:-

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any query or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact at 9633181898 or via WhatsApp at 9633181898.

Featured Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

Latest Posts

- Restoration of GST Registration Allowed Subject to Filing of Returns and Payment of Dues -Jammu & Kashmir High Court

- റിട്ടേണുകൾ സമർപ്പിക്കുകയും കുടിശ്ശികകൾ അടയ്ക്കുകയും ചെയ്യുന്നുവെന്ന നിബന്ധനയ്ക്ക് വിധേയമായി ജിഎസ്ടി രജിസ്ട്രേഷൻ പുനഃസ്ഥാപിക്കാൻ ജമ്മു & കാശ്മീർ ഹൈക്കോടതി അനുമതി നൽകി.

- Allahabad High Court Quashes GST Demand Over Procedural Lapses: Wrong GSTIN, Demand Beyond SCN & Improper Service.

- തെറ്റായ GSTIN, അറിയിക്കാത്ത അധിക ഡിമാൻഡ്, നോട്ടീസ് ലഭിക്കാത്തത് – ഗുരുതര പിഴവുകൾ ചൂണ്ടിക്കാട്ടി GST ഉത്തരവ് അലഹാബാദ് ഹൈക്കോടതി റദ്ദാക്കി.

- No More Silent Auditor Changes — ICAI Releases Updated UDIN Portal Manual with Strong New Mandates.

Popular Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

BRQ GLOB TECH

BRQ GLOB TECH