GSTN Advisory on amnesty scheme for filing time barred appeals

GSTN Advisory

GSTN Advisory on amnesty scheme for filing time barred appeals

GSTN Advisory on amnesty scheme for filing time barred appeals

Amnesty scheme for Taxpayers:

The GST Council, in its 52nd meeting, recommended granting amnesty to taxpayers who couldn't file an appeal under section 107 of the CGST (Central Goods and Services Tax) Act, 2017, against the demand order under section 73 or 74 of the CGST Act, 2017, passed on or before March 31, 2023, or whose appeal against the said order was rejected due to not being filed within the specified time frame in sub-section (1) of section 107.

Notification:

In compliance with the above GST Council's recommendation, the government has issued Notification No. 53/2023 on November 2, 2023.

Payment:

It is further advised that the taxpayers should make payments for entertaining the appeal by the Appellate officer as per the provisions of Notification No. 53/2023. The GST Portal allows taxpayers to choose the mode of payment (electronic Credit/Cash ledger), and it's the responsibility of the taxpayer to select the appropriate ledgers and make the correct payments. Further, the office of the Appellate Authority shall check the correctness of the payment before entertaining the appeal and any appeal filed without proper payment may be dealt with as per the legal provisions.

If a taxpayer has already filed an appeal and wants it to be covered by the benefit of the amnesty scheme would need to make differential payments to comply with Notification No. 53/2023.

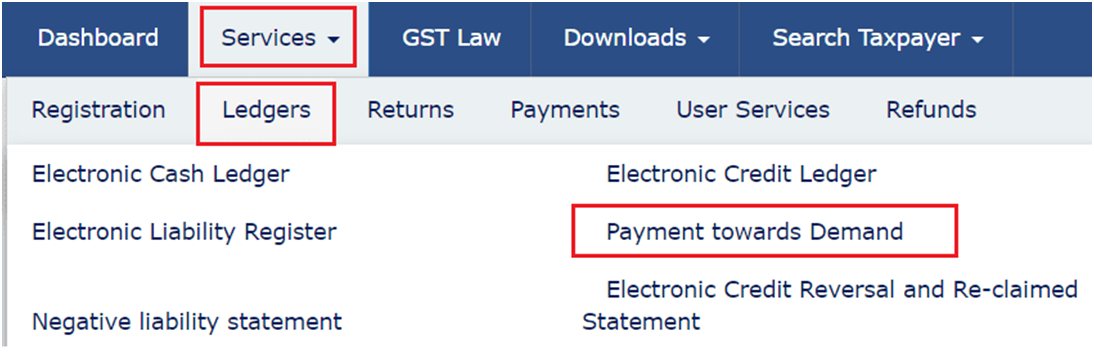

The payment should be made against the demand order using the 'Payment towards demand' facility available on the GST portal. The navigation step for making this payment is provided:

Login >> Services >> Ledgers >> Payment towards Demand.

Form for Appeal:

Taxpayers can now file appeal in FORM GST APL-01 on the GST portal on or before January 31, 2024 for the order passed by proper officer on or before March 31, 2023.

DISCLAIMER:-

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any query or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact at 9633181898 or via WhatsApp at 9633181898.

Featured Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

Latest Posts

- Restoration of GST Registration Allowed Subject to Filing of Returns and Payment of Dues -Jammu & Kashmir High Court

- റിട്ടേണുകൾ സമർപ്പിക്കുകയും കുടിശ്ശികകൾ അടയ്ക്കുകയും ചെയ്യുന്നുവെന്ന നിബന്ധനയ്ക്ക് വിധേയമായി ജിഎസ്ടി രജിസ്ട്രേഷൻ പുനഃസ്ഥാപിക്കാൻ ജമ്മു & കാശ്മീർ ഹൈക്കോടതി അനുമതി നൽകി.

- Allahabad High Court Quashes GST Demand Over Procedural Lapses: Wrong GSTIN, Demand Beyond SCN & Improper Service.

- തെറ്റായ GSTIN, അറിയിക്കാത്ത അധിക ഡിമാൻഡ്, നോട്ടീസ് ലഭിക്കാത്തത് – ഗുരുതര പിഴവുകൾ ചൂണ്ടിക്കാട്ടി GST ഉത്തരവ് അലഹാബാദ് ഹൈക്കോടതി റദ്ദാക്കി.

- No More Silent Auditor Changes — ICAI Releases Updated UDIN Portal Manual with Strong New Mandates.

Popular Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

BRQ GLOB TECH

BRQ GLOB TECH