GST on Bank Guarantee given by Directors or Corporates

Press Release - 52nd GST Council Meeting

GST on Bank Guarantee given by Directors or Corporates

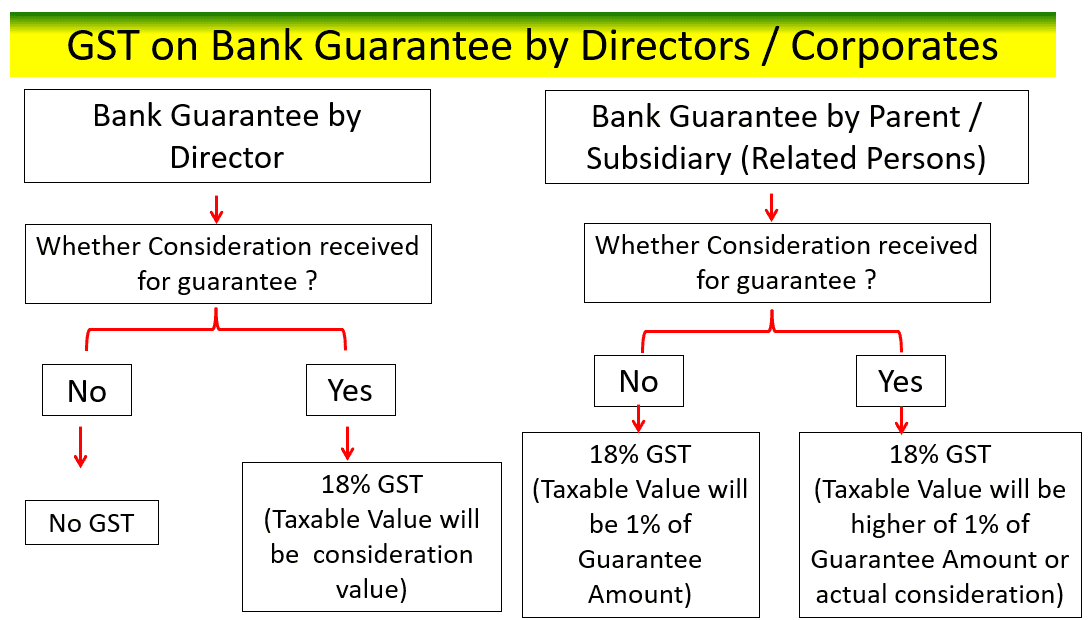

In corporates, it is quite common to offer personal guarantees to bank by Directors for loans sought by companies or corporate guarantee given by Parent company for loans sought by its subsidiaries. Taxation of GST on such guarantees has been a burning issue as several companies in past has been subjected to GST notices for this.

Now the GST Council in its 52nd meeting held on 07th Oct 2023 has clarified and proposed certain amendments related to Bank Guarantees given by Directors or Corporates to bank against credit limits or loans. The press release states the following rules.

Clarifications regarding taxability of personal guarantee offered by directors to the bank against the credit limits/loans being sanctioned to the company and regarding taxability of corporate guarantee provided for related persons including corporate guarantee provided by holding company to its subsidiary company: The Council has inter alia recommended to:

(a) issue a circular clarifying that when no consideration is paid by the company to the director in any form, directly or indirectly, for providing personal guarantee to the bank/ financial institutes on their behalf, the open market value of the said transaction/ supply

may be treated as zero and hence, no tax to be payable in respect of such supply of services.

(b) to insert sub-rule (2) in Rule 28 of CGST Rules, 2017, to provide for taxable value of supply of corporate guarantee provided between related parties as one per cent of the amount of such guarantee offered, or the actual consideration, whichever is higher.

(c) to clarify through the circular that after the insertion of the said sub-rule, the value of such supply of services of corporate guarantee provided between related parties would be governed by the proposed sub-rule (2) of rule 28 of CGST Rules, 2017, irrespective of whether full ITC is available to the recipient of services or not.

DISCLAIMER:-

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any query or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact at 91-96-33-18-18-98.

DISCLAIMER:-

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any query or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact at 9633181898 or via WhatsApp at 9633181898.

Featured Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

Latest Posts

- Restoration of GST Registration Allowed Subject to Filing of Returns and Payment of Dues -Jammu & Kashmir High Court

- റിട്ടേണുകൾ സമർപ്പിക്കുകയും കുടിശ്ശികകൾ അടയ്ക്കുകയും ചെയ്യുന്നുവെന്ന നിബന്ധനയ്ക്ക് വിധേയമായി ജിഎസ്ടി രജിസ്ട്രേഷൻ പുനഃസ്ഥാപിക്കാൻ ജമ്മു & കാശ്മീർ ഹൈക്കോടതി അനുമതി നൽകി.

- Allahabad High Court Quashes GST Demand Over Procedural Lapses: Wrong GSTIN, Demand Beyond SCN & Improper Service.

- തെറ്റായ GSTIN, അറിയിക്കാത്ത അധിക ഡിമാൻഡ്, നോട്ടീസ് ലഭിക്കാത്തത് – ഗുരുതര പിഴവുകൾ ചൂണ്ടിക്കാട്ടി GST ഉത്തരവ് അലഹാബാദ് ഹൈക്കോടതി റദ്ദാക്കി.

- No More Silent Auditor Changes — ICAI Releases Updated UDIN Portal Manual with Strong New Mandates.

Popular Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

BRQ GLOB TECH

BRQ GLOB TECH