GST Appeal & Guide To File Appeal Against Demand Order Under GST

GST Appeal

GST Appeal & Guide To File Appeal Against Demand Order Under GST

GST Appeal & Guide To File Appeal Against Demand Order Under GST

GST Appeal

Any taxpayer whether registered or not can file an appeal if he/she is unhappy with the decision of the adjudicating authority. The appeal must be filed within three months from the date on which such order was communicated to the taxpayer, and has the power to condone the delay by one month, if the appeal authority satisfied that there exists a sufficient cause.

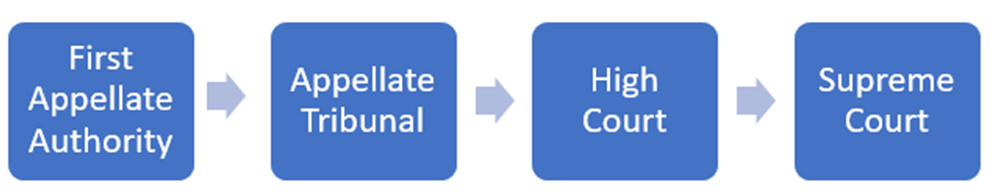

Steps of appeals under GST

| Appeal level | Orders passed by.... | Appeal to - - | Sections of Act |

| 1st | Adjudicating Authority | First Appellate Authority | 107 |

| 2nd | First Appellate Authority | Appellate Tribunal | 109,110 |

| 3rd | Appellate Tribunal | High Court | 111-116 |

| 4th | High Court | Supreme Court | 117-118 |

Should every appeal be made to both CGST & SGST authorities?

No. As per the GST Act, CGST & SGST / UTGST officers are both empowered to pass orders. As per the Act, an order passed under CGST will also be deemed to apply to SGST. However, if an officer under CGST has passed an order, any appeal/review/ revision/rectification against the order will lie only with the officers of CGST. Similarly, for SGST, for any order passed by the SGST officer the appeal/review/revision/rectification will lie with the proper officer of SGST only.

Filing of a GST appeal

To file an appeal under GST to the Appellate Authority, you can follow the procedure detailed in this article here.

Time limit for filing a GST appeal

An applicant can file an appeal before the Appellate Authority within three months from the date of communication of the disputed order. Further, the Appellate Authority may condone a delay of up to one month if they are satisfied that there was a sufficient cause for such delay.

General rules for filing GST appeals

All appeals must be made in prescribed forms along with the required fees. Fee will be - The full amount of tax, interest, fine, fee and penalty arising from the challenged order, as admitted by appellant, AND -10% of the disputed amount In cases where an officer or the Commissioner of GST is appealing then fees will not be applicable.

Can an authorized representative appear in court?

Yes. Any person required to appear before a GST Officer/First Appellate Authority/Appellate Tribunal can assign an authorized representative to appear on his behalf, unless he is required by the Act to appear personally. An authorized representative can be-

- a relative

- a regular employee

- a lawyer practicing in any court in India

- any chartered accountant/cost accountant/company secretary, with a valid certificate of practice

- a retired officer of the Tax Department of any State Government or of the Excise Dept. whose rank was minimum Group-B gazetted officer

- any tax return preparer

Retired officers cannot appear in place of the concerned person within one year from the date of their retirement.

Appeal cannot be filed in certain cases

The Board or the State Government may, on the recommendation of the Council, fix monetary limits for appeals by the GST officer to regulate the filing of appeal and avoid unnecessary litigation expenses Can all decisions be appealed against? No. Appeals cannot be made for the following decisions taken by a GST officer-

- An order to transfer the proceedings from one officer to another officer;

- An order to seize or retain books of account and other documents;

- An order sanctioning prosecution under the Act; or

- An order allowing payment of tax and other amount in installments

A person unhappy with any decision or order passed against him under GST by an adjudicating authority can appeal to the First Appellate Authority. If they are not happy with the decision of the First Appellate Authority they can appeal to the National Appellate Tribunal, then to High Court and finally Supreme Court.

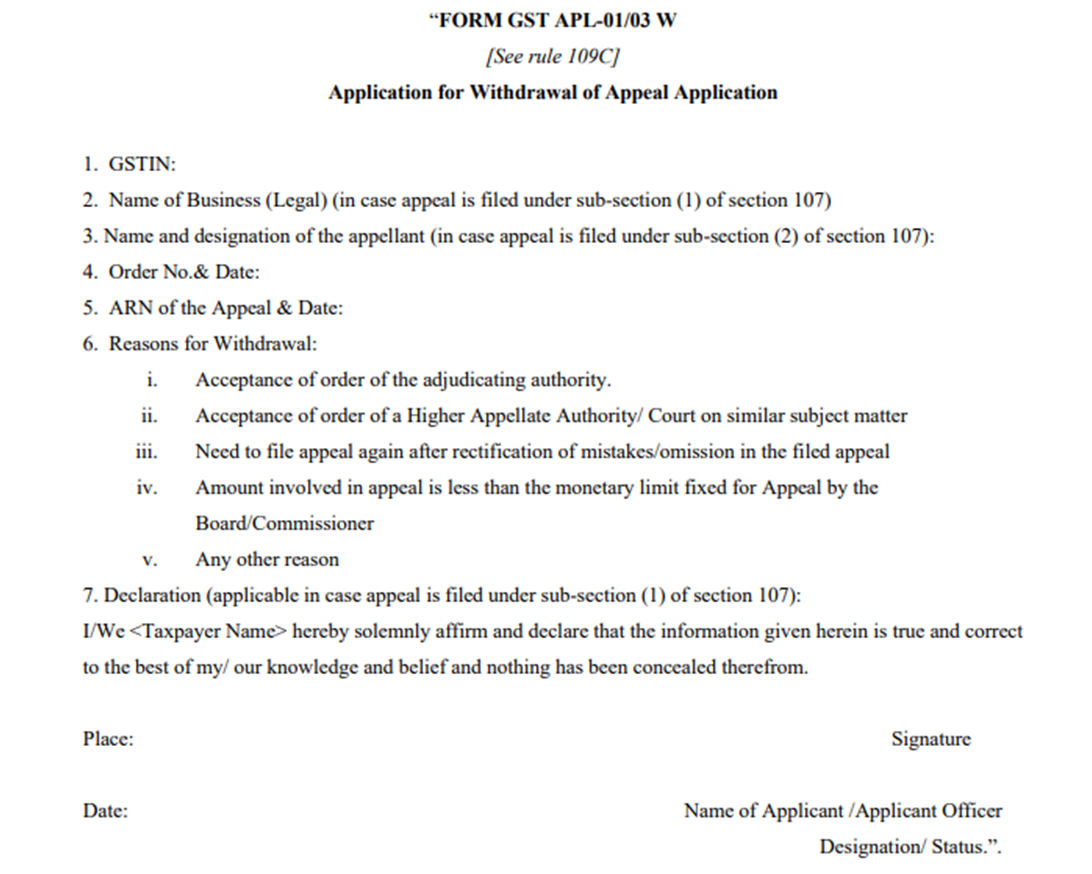

Withdrawal of a GST appeal

In the 48th GST Council meeting, it was decided to provide an option of withdrawal of a GST appeal that has already been filed. This move was made with the intention of reducing the number of litigations that the appellate authorities have to deal with. In this regard, a new Rule 109C was inserted in the CGST Rules via Notification No.26/2022- Central Tax.

Rule 109C states that the applicant can file an application for withdrawal of an appeal at any time before the show cause notice or order under Section 107(11) is issued, whichever is earlier. This is in respect of any appeal filed in Form GST APL-01 or Form GST APL-03. The application for withdrawal of the appeal will need to be submitted using the new Form GST APL-01/03W.

It is important to note here that in cases where the final acknowledgment in Form GST APL-02 has been issued, then the withdrawal of the said appeal will require the approval of the appellate authority. The appellate authority must make a decision on the application for withdrawal of the appeal within seven days of the applicant filing the same. Any fresh appeal filed by an appellant after such withdrawal should be within the time limits specified under Section 107.

Steps to file the First Appeal against Demand Order

Pre-conditions to file an appeal:

- Order must be passed by the adjudicating authority for a taxpayer to file an appeal to the Appellate Authority.

- Prepare appeal memorandum

- Prepare condonation delay petition in case of Delay

- Prepare \arrange all supporting documents

- Pay 10% disputed Tax towards the demand as pre-deposit

- Pay extra 2.5% disputed Tax towards the demand as pre-deposit in case of adopting GST amnesty scheme to comply with Notification No. 53/2023.

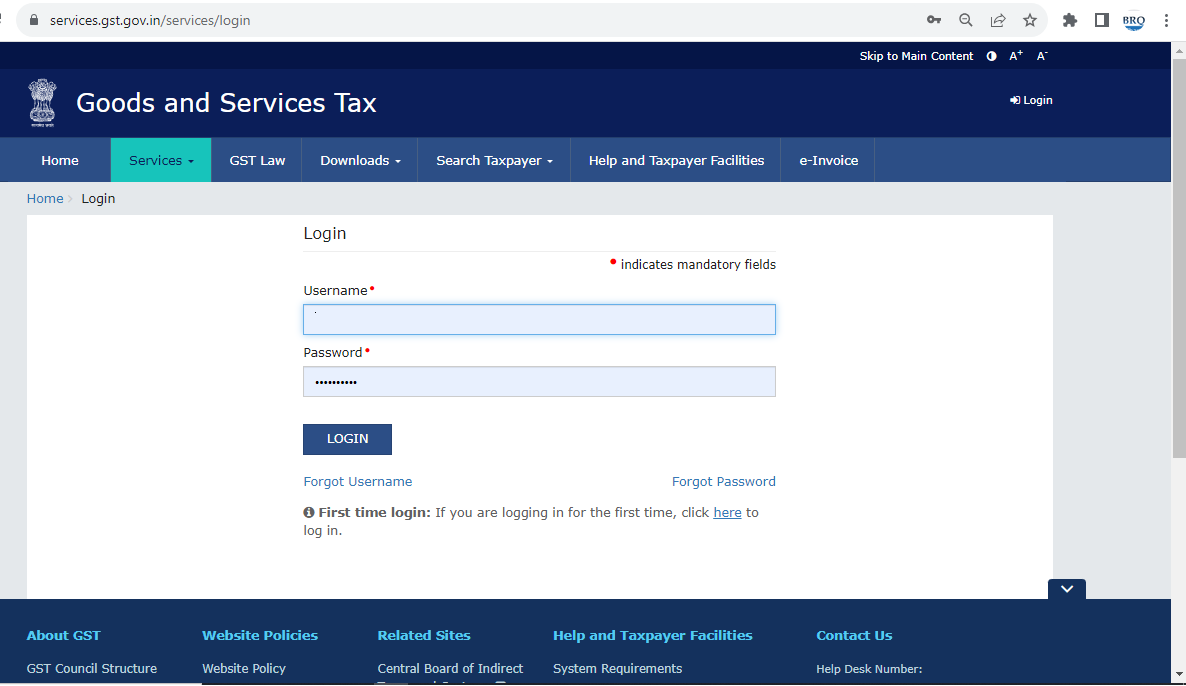

Step 1: Log in to the GST portal.

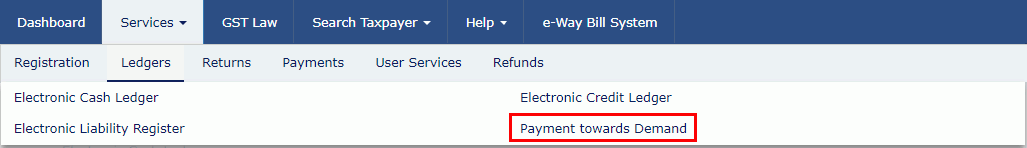

Step 2: Go to Services > User Services > Ledgers >> Payment towards Demand

Step 3: Select the Demand ID

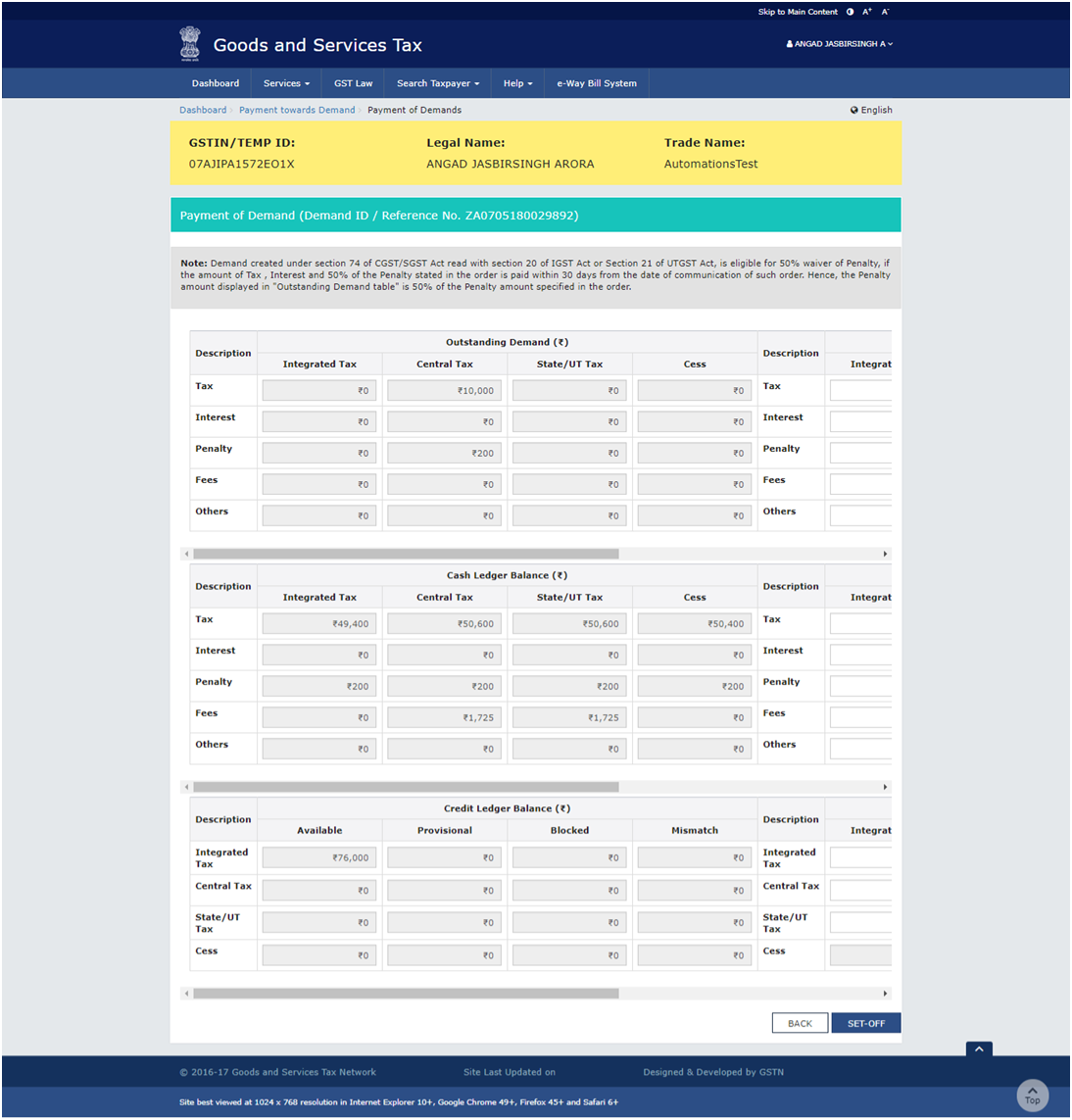

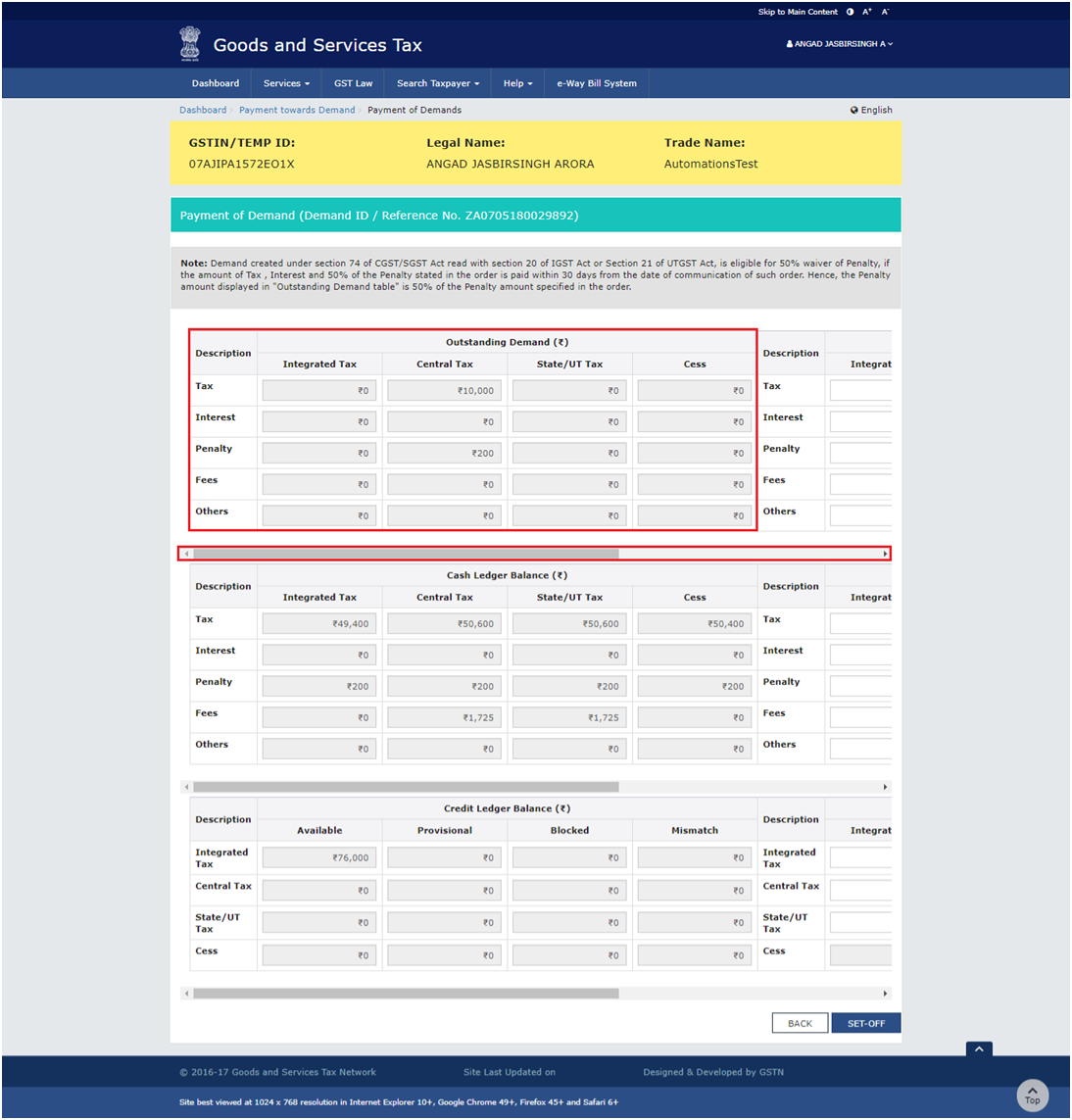

The taxpayer has to click on the ‘Select’ button to select the Demand ID for which the payment has to be made. Once that is done, the Outstanding Demand, Cash Ledger Balance and the Credit Ledger Balance details are displayed on the screen.

Outstanding Demand

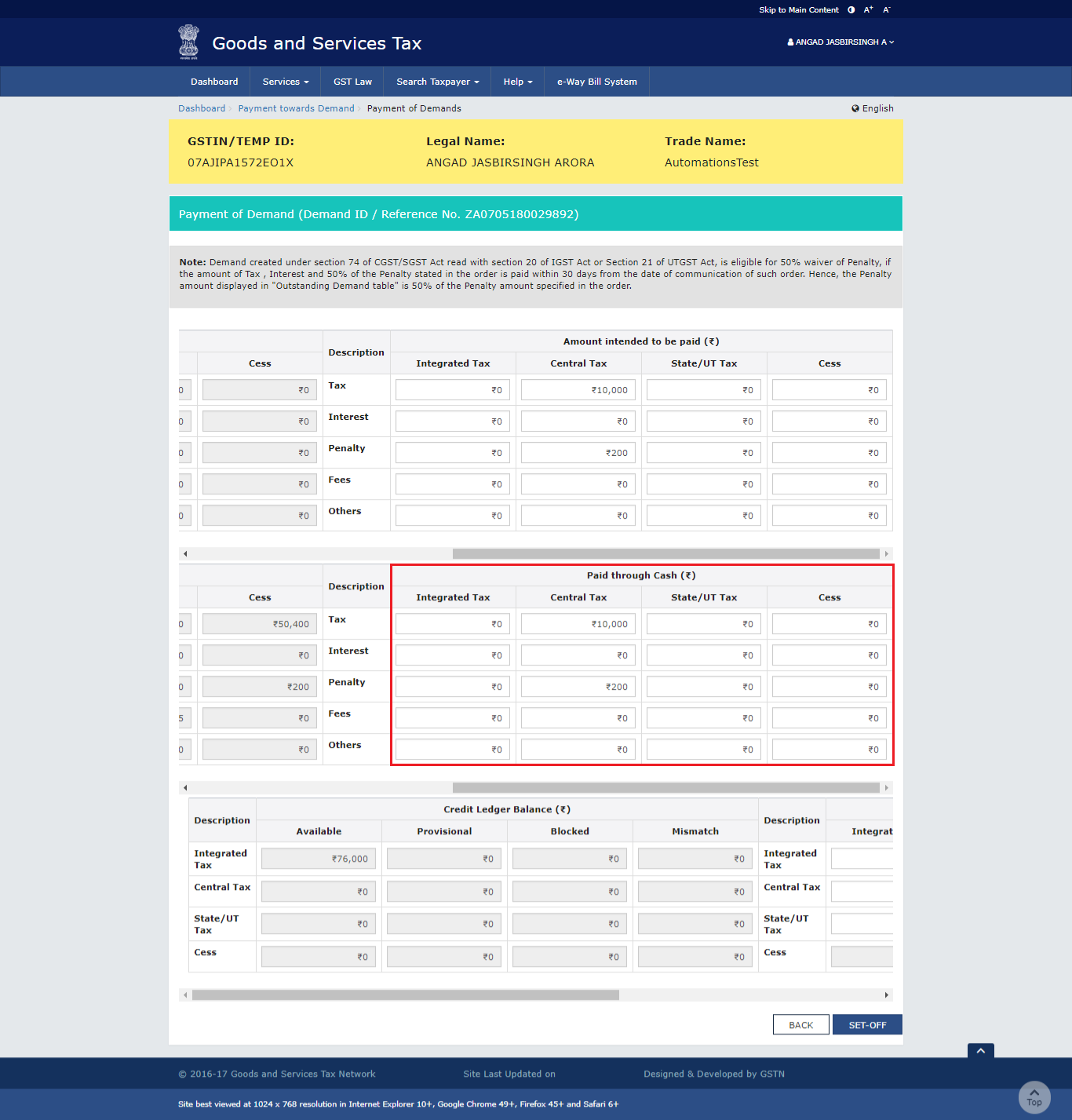

Amount Intended to be paid against the Outstanding Demand

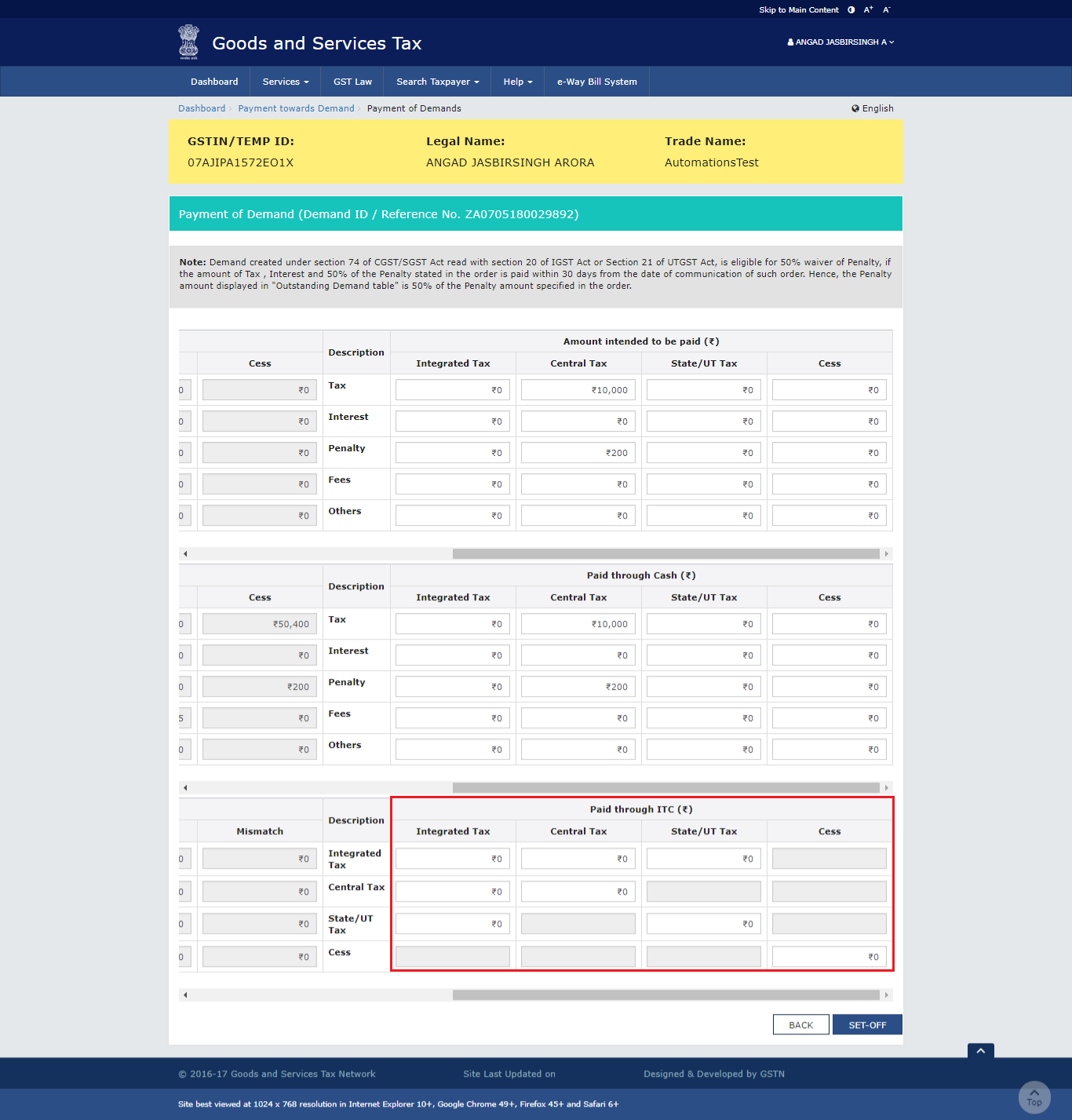

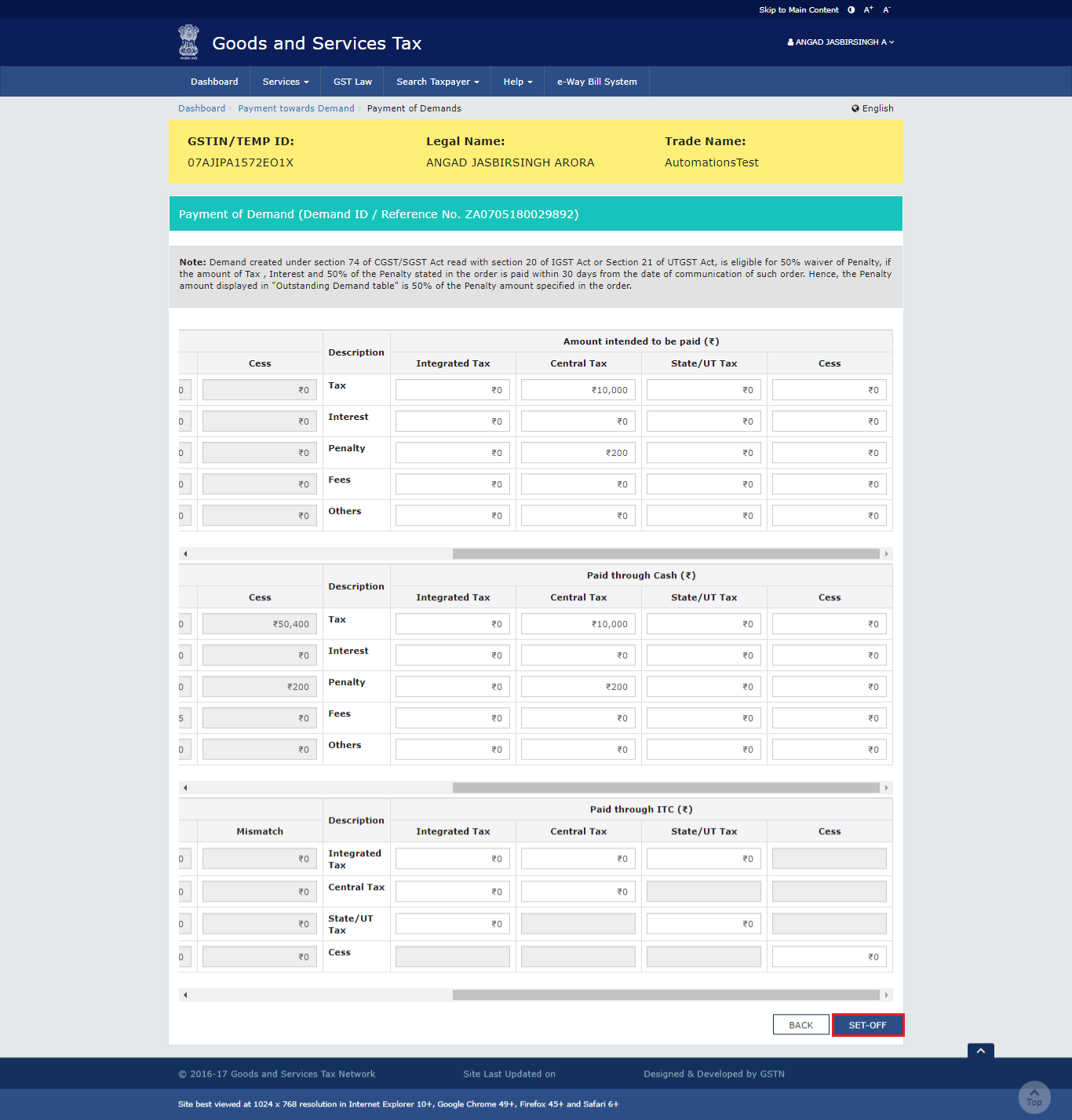

The taxpayer has to use the scroll bar to move to the right to enter the amount intended to be paid against the Demand ID.

Pay using the cash or ITC lying in the electronic ledger: The taxpayer can make the payment by either utilising the cash or the balance of ITC available for utilisation in the ledger.

Cash Ledger Balance

The available cash is given below.

Amount of Outstanding Demand Paid through Cash

The taxpayer has to use the scroll bar to move to the right to enter the amount that has to be paid through cash against the Demand ID.

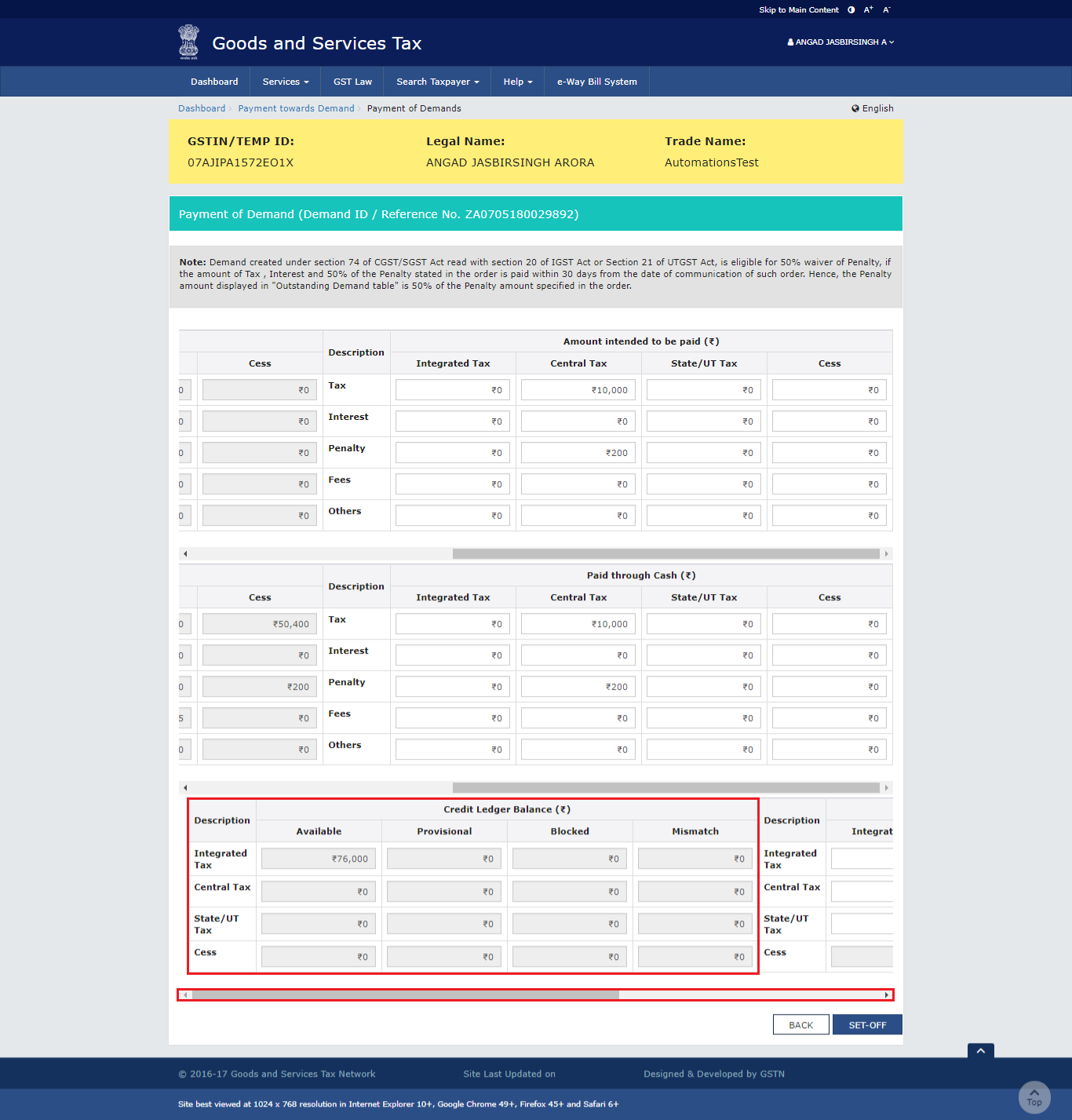

Credit Ledger Balance

The ITC available is shown below.

Credit Ledger BalanceAmount of Outstanding Demand Paid through Credit

The taxpayer has to use the scroll bar to move to the right to enter the amount that has to be paid through ITC against the Demand ID.

Click the Set-Off button

Once the amount is entered, the taxpayer has to click the ‘Set-Off’ button.

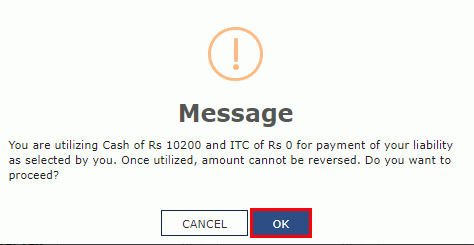

Click OK

A confirmation message will be displayed, in which the taxpayer has to click on the ‘OK’ button.

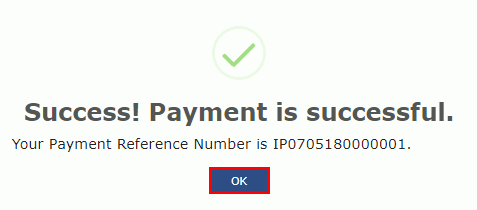

Payment Reference Number

A success message along with the Payment Reference Number is displayed on the screen. Click ‘OK’ button.

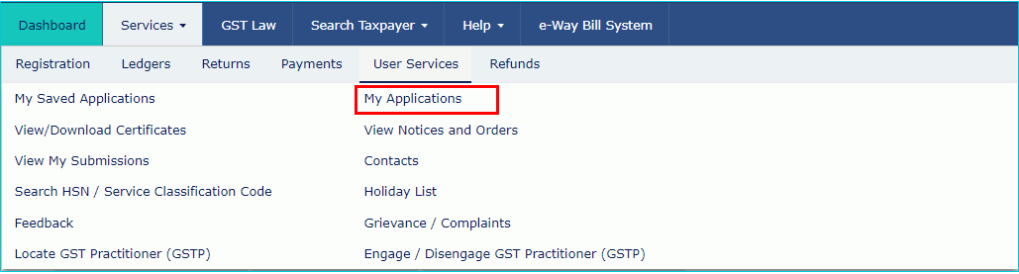

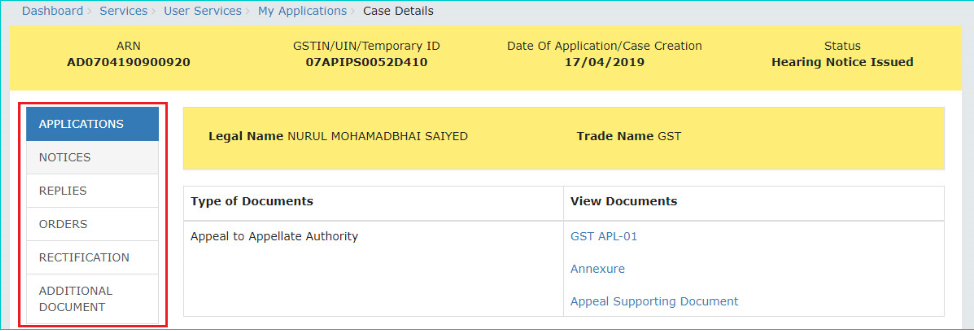

Step 4: File Appeal - Go to Services > User Services > My applications

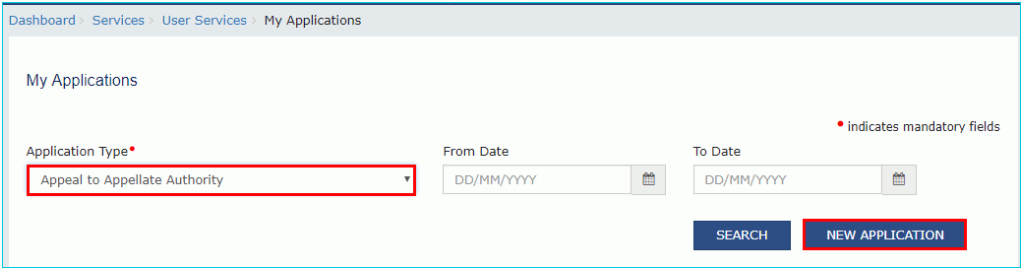

On the ‘My Applications’ page, select application type as ‘Appeal to Appellate Authority’ and then click on ‘New Application’.

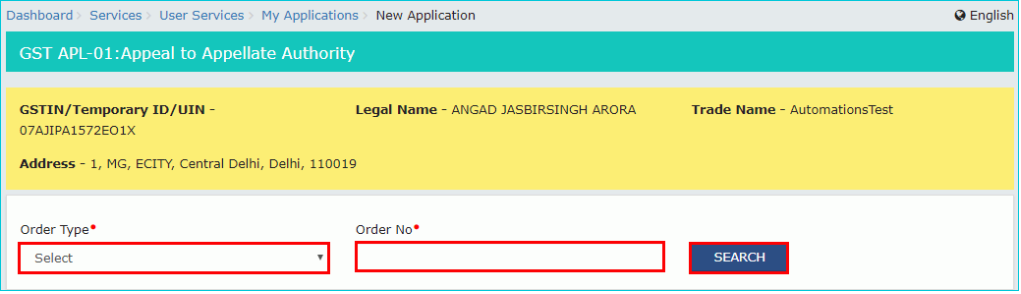

The ‘GST APL-01-Appeal to Appellate Authority’ page will be displayed.

Step 5: Select the order type as ‘Demand Order’ and enter the order number. Click on search.

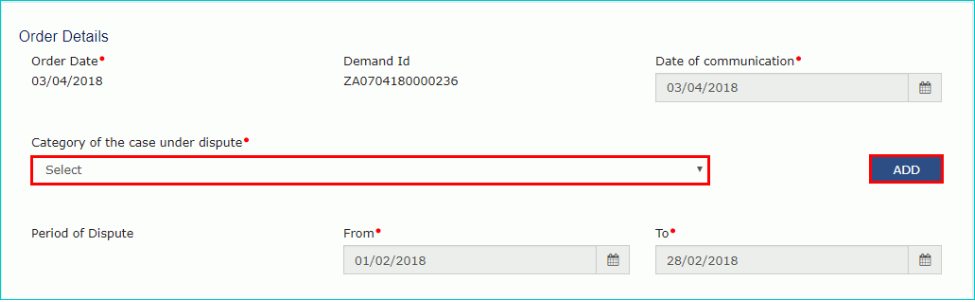

The orders page will be displayed.

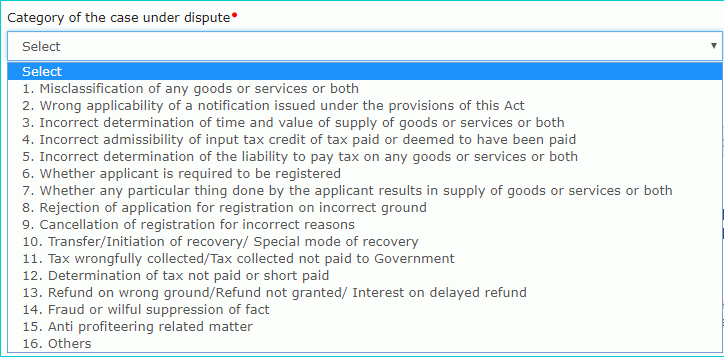

Step 6: Select the one or more categories of the case under dispute from the drop-down list and click on add.

Following is the list of cases:

The date of communication and period of dispute can be edited by the taxpayer.

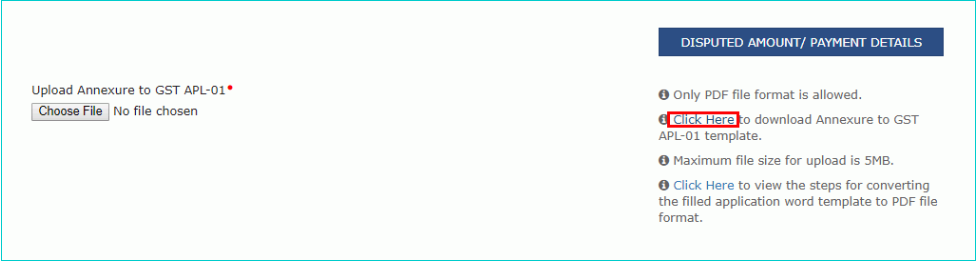

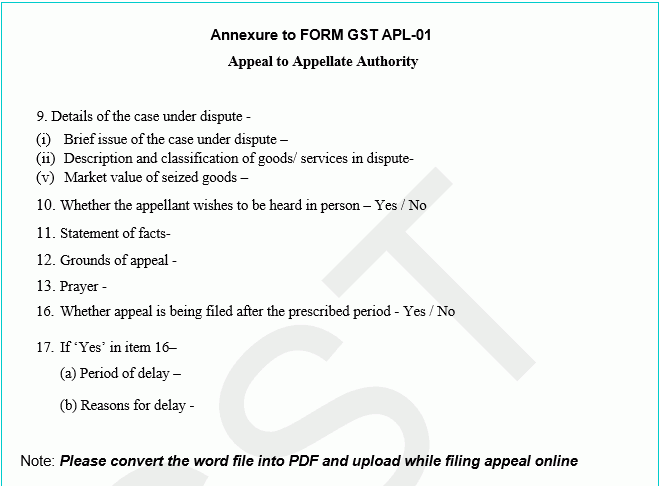

Step 7: Upload annexure to GST APL-01- Click on the ‘click here’ link on the order page.

The GST APL-01 template will be downloaded. Click on the ‘Enable Editing’ button and update the details in the annexure.

Save the updated file as ‘AplAnnexureTemplate.pdf’ and upload the same.

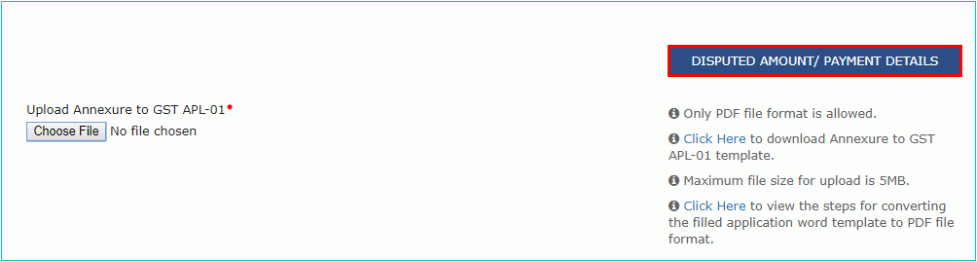

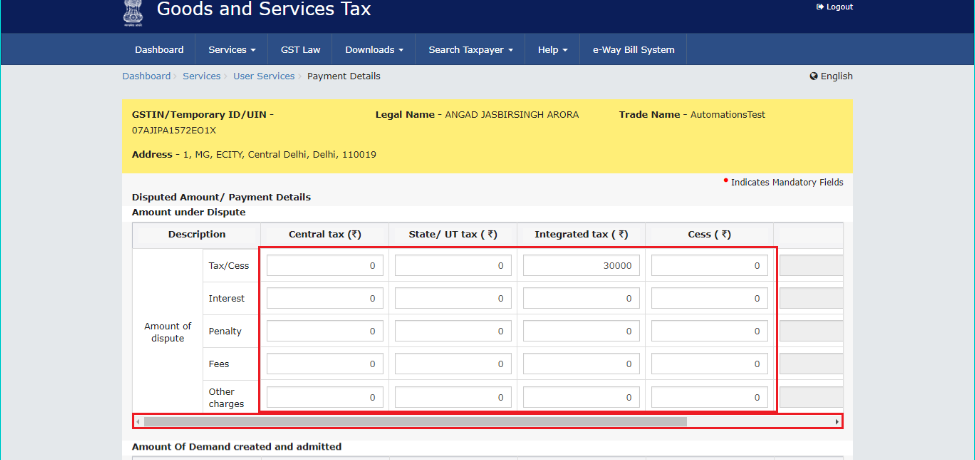

Step 8: Update the disputed amount/payment details by clicking on the ‘Disputed amount/Payment details’ button on the order page.

- Enter the amount under dispute by classifying it as per the tax head, late fee or interest.

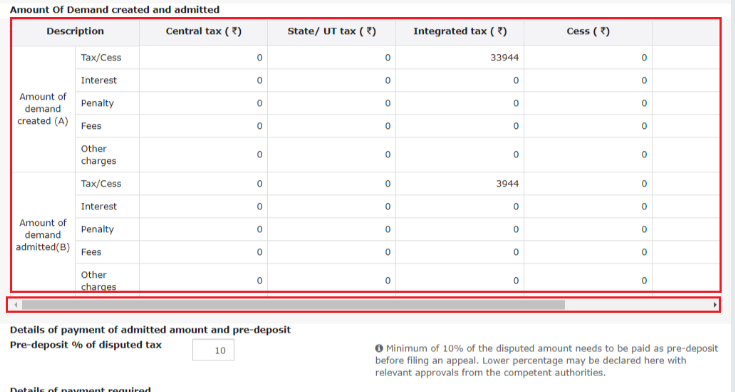

2. The amount of demand created and admitted is automatically displayed.

Note: Demand admitted = Demand created - Amount disputed.

Hence, the amount of dispute cannot be more than the demand created.

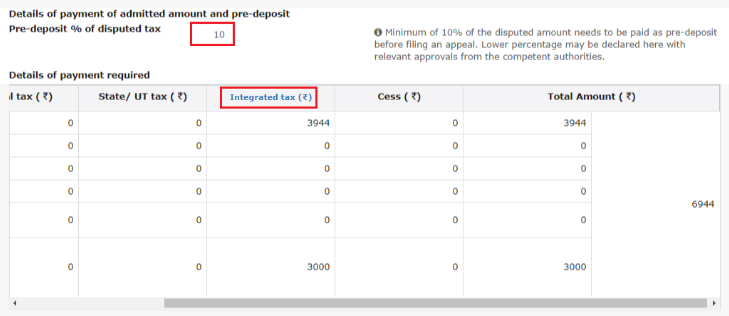

3. Enter the percentage value of the pre-deposit going to be paid, which is by default a minimum of 10% of the amount disputed.

A lower percentage needs approval from the authority. Accordingly, the ‘Details of Payment required’ table is auto-filled.

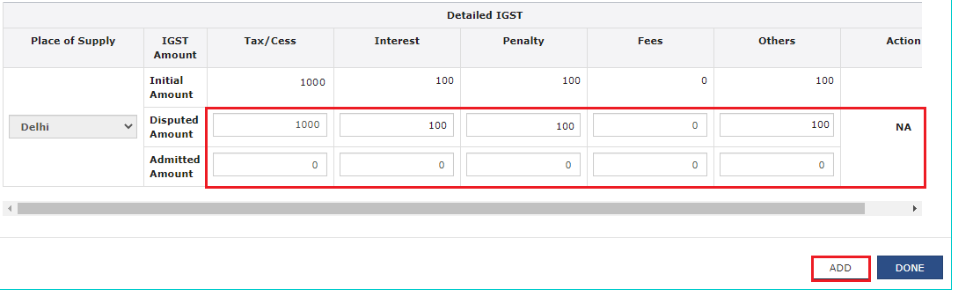

4. Enter the place of supply details for the amount of demand admitted. For this, click on hyperlink ‘Integrated Tax’ as follows:

5. Pay using the cash or ITC lying in the electronic ledger: The taxpayer can make the payment by either utilising the cash or the balance of ITC available for utilisation in the ledger.

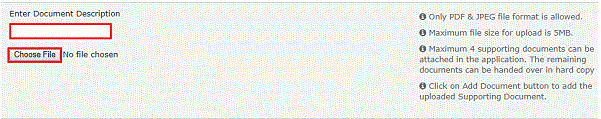

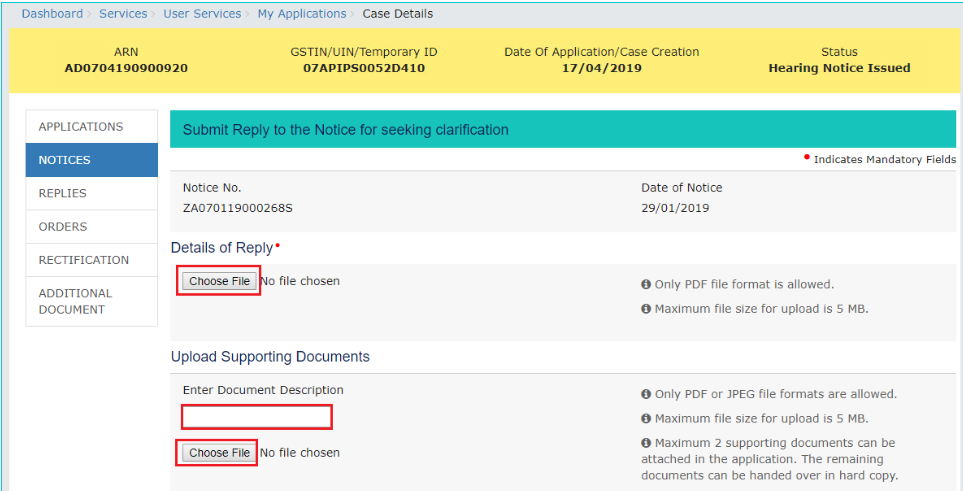

Step 9: Add supporting documents if needed. Enter the document description and then choose the file for upload. Follow the criteria given in the below image:

Step 10: An applicant can preview the application filed by clicking on the ‘Preview’ button. The PDF file will be downloaded. The applicant view whether the details are correctly updated and then proceed to file.

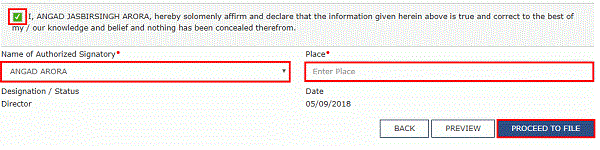

Step 11: Proceed to file - Select the declaration checkbox. Then select the authorised signatory and enter the place to proceed to file.

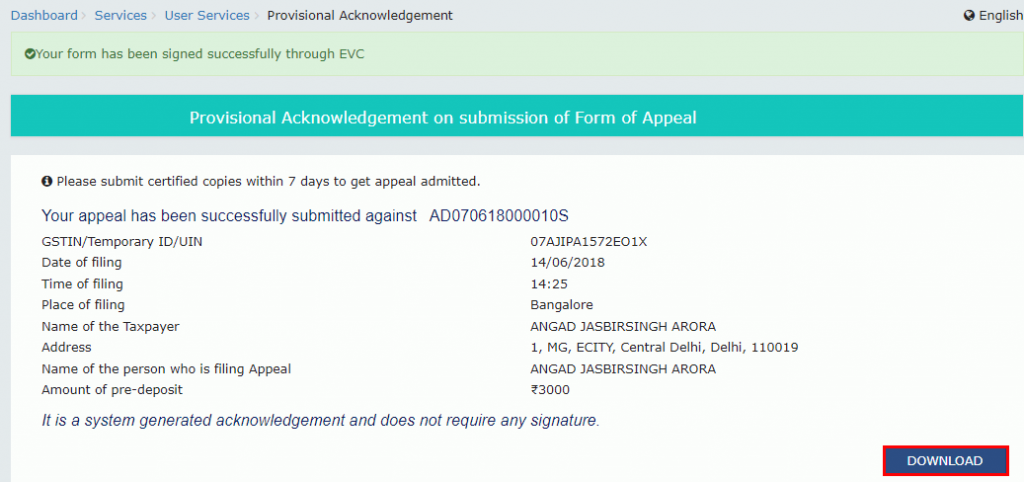

Click submit and proceed to file with DSC or EVC. On successful submission, a confirmation message will be displayed.

Steps to file Reply during an Appeal Proceeding

The Appellate Authority may begin proceedings and hearing for the disposition of the appeal or may summon the appellant during the review of the tax department’s application for an appeal. A taxpayer needs to follow the below steps to reply during an appeal proceeding:

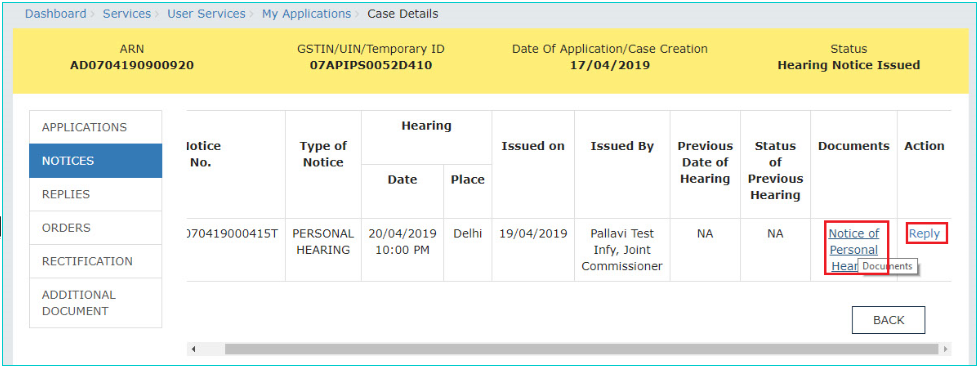

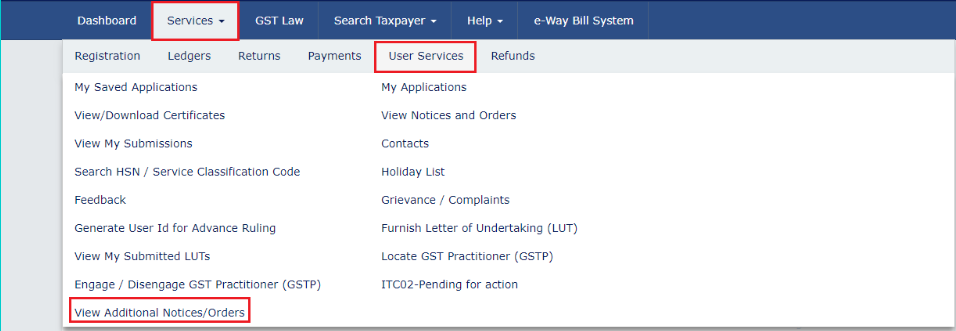

Step 1: Log in to the GST portal and navigate to Services>User Services>View Additional Notices/Orders.

Step 2: On the case details page of the particular Case ID, select the notice tab and then click on reply. A ‘Submit a reply to the notice’ page will open.

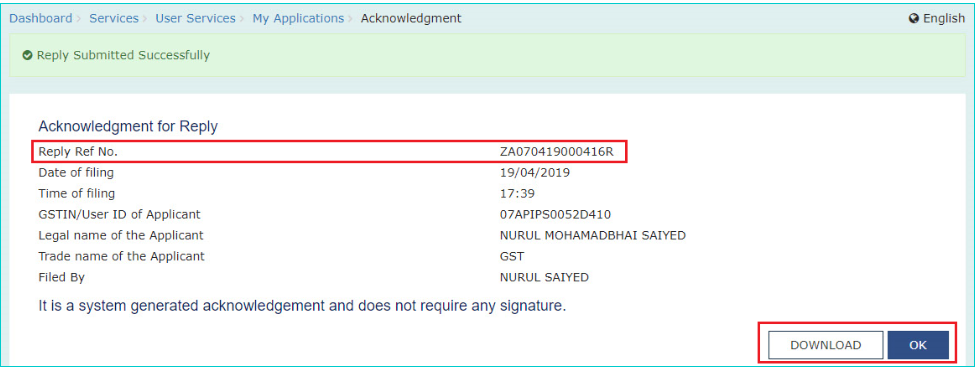

Step 3: Upload the reply file, upload the supporting documents, check the verification checkbox and then click on the ‘File Reply’ button.

A warning message will pop-up. Click proceed and then submit with DSC or EVC. An acknowledgement will pop-up on successful upload of reply.

Steps to file a Rectification Request of an Appeal

Step 1: Login to the GST portal.

Step 2: Navigate to Services>User Services>View Additional Notices/Orders Click on view on the ‘Additional Notices/orders’ page.

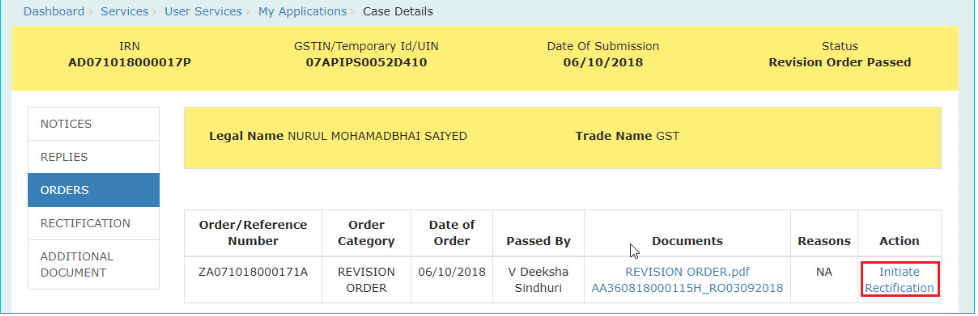

Case Details page displayed.

Step 3: Click on the ‘Orders’ tab and select ‘Initiate rectification’.

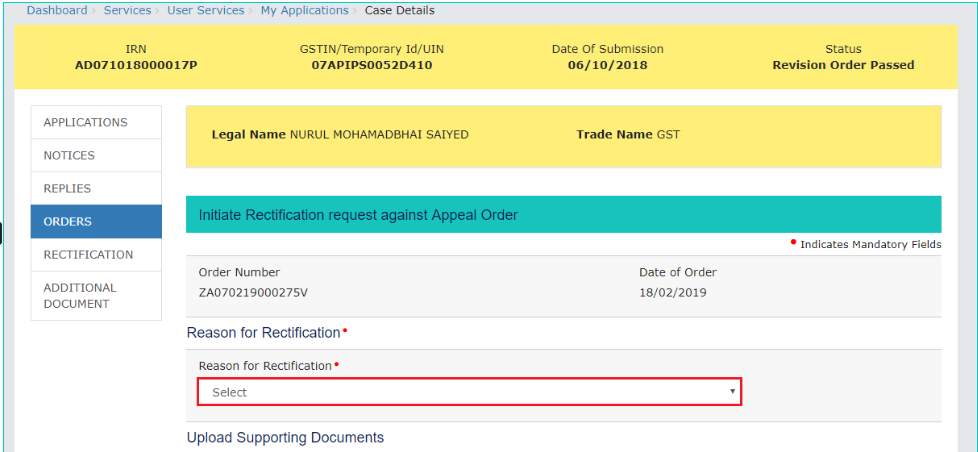

Step 4: The initiate rectification page will be displayed. Choose the relevant rectification reason and upload the supporting documents if required. Then click on ‘Initiate’ and submit with either DSC or EVC.

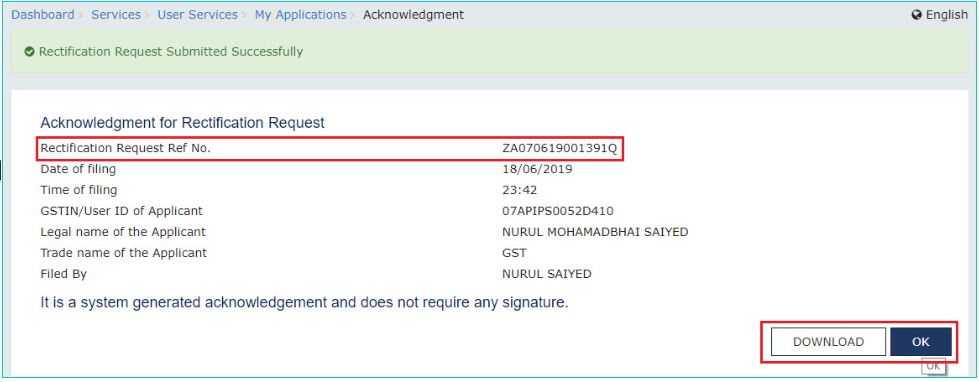

On successful submission, a message will pop up stating the rectification request Number.

Frequently Asked Questions on filing Appeal against Demand Order

What are various appeal statuses?

| Sr.No. | Description | Status |

| 1 | Appeal form successfully filed | Appeal submitted |

| 2 | Appeal form successfully admitted | Appeal admitted |

| 3 | When an appeal form is rejected | Appeal rejected |

| 4 | When hearing notice is issued | Hearing notice issued |

| 5 | When counter reply received against a notice | Counter reply received |

| 6 | Issue of Show cause notice | Show cause notice issued |

| 7 | Appeal is confirmed/modified/rejected | Appeal order passed |

| 8 | Adjournment of hearing to next date | Adjournment granted |

| 9 | Rectification application filed | Rectification request received |

| 10 | Rectification application is rejected | Rectification request rejected |

| 11 | An appeal in order is rectified | Rectification order passed |

What happens if the taxpayer does not file the appeal within three months?

The Appellate Authority may condone the delay by one month if it is satisfied that the taxpayer was prevented by sufficient cause from presenting the appeal.

Is it necessary to deposit 10% of disputed tax and whether the disputed tax balance remains on filing an appeal?

Minimum 10% of pre-disputed tax needs to be paid as a deposit before filing an appeal. Once the status of appeal filed changes to ‘Admitted’, the GST portal flags the disputed amount as non-recoverable.

From where can a taxpayer view a submitted appeal?

A taxpayer has to navigate to Services>User Services>My Applications>Application Type as Appeal to Appellate Authority>From and To Date>SEARCH button.

DISCLAIMER:-

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any query or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact at 9633181898 or via WhatsApp at 9633181898.

Featured Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

Latest Posts

- Restoration of GST Registration Allowed Subject to Filing of Returns and Payment of Dues -Jammu & Kashmir High Court

- റിട്ടേണുകൾ സമർപ്പിക്കുകയും കുടിശ്ശികകൾ അടയ്ക്കുകയും ചെയ്യുന്നുവെന്ന നിബന്ധനയ്ക്ക് വിധേയമായി ജിഎസ്ടി രജിസ്ട്രേഷൻ പുനഃസ്ഥാപിക്കാൻ ജമ്മു & കാശ്മീർ ഹൈക്കോടതി അനുമതി നൽകി.

- Allahabad High Court Quashes GST Demand Over Procedural Lapses: Wrong GSTIN, Demand Beyond SCN & Improper Service.

- തെറ്റായ GSTIN, അറിയിക്കാത്ത അധിക ഡിമാൻഡ്, നോട്ടീസ് ലഭിക്കാത്തത് – ഗുരുതര പിഴവുകൾ ചൂണ്ടിക്കാട്ടി GST ഉത്തരവ് അലഹാബാദ് ഹൈക്കോടതി റദ്ദാക്കി.

- No More Silent Auditor Changes — ICAI Releases Updated UDIN Portal Manual with Strong New Mandates.

Popular Posts

- Income Tax Computation For Individuals: Rules And Rates

- New RCM for Indian Exporters from 01/10/23: Place of Supply Changes

- Who will be considered as the owner of the goods

- Unregistered persons can enroll now in GST for supply of goods through e-commerce operators.

- GSTN Simplified Integration for E-commerce Operators with Unregistered Suppliers who wish supply through E-commerce Operators

BRQ GLOB TECH

BRQ GLOB TECH