GSTR-9 & GSTR-9C Manual for FY 2024-25

AUTHOR :Muhammed Mustafa C T

https://taxgtower.blog/brqblog/my_post_view/GSTR-9-GSTR-9C-Manual-for-FY-2024-25-1-737-423GSTR-9 & GSTR-9C Manual for FY 2024-25 (Table-wise with Updated CBIC Instructions)

As the due date for filing GSTR-9 and GSTR-9C for FY 2024-25 is approaching, professionals have already begun working proactively to ensure timely completion and compliance.

Like every year, we have released the comprehensive GSTR-9 & GSTR-9C Manual for FY 2024-25, prepared exclusively for professionals and followers to simplify filing and reconciliation.

This updated manual includes:

Table-wise breakup with mandatory, optional, and auto-fill details

Latest CBIC instructions and portal-related updates

Practical guidance for accurate and error-free filing

Access the manual through the link below:

Click below to download Table wise GSTR-9 manual for FY 2024-25

https://drive.google.com/file/d/1YA5IO0wW4lNmz7hFI5UMcw1tKqkEvJaC/view?usp=sharing

Click the below link to download Table wise GSTR-9C manual for FY 2024-25

https://drive.google.com/file/d/12G48_ieHDqygDKcVTVSl_4ekFixq7cpc/view?usp=sharing

Click the below link to download FAQ by GSTN on GSTR-9 & GSTR-9C

https://drive.google.com/file/d/1luwOPY-I-zFQGtGBgN7xmb5l-OZq5Cny/view?usp=sharing

Who is required to file GSTR-9 (Annual Return)?

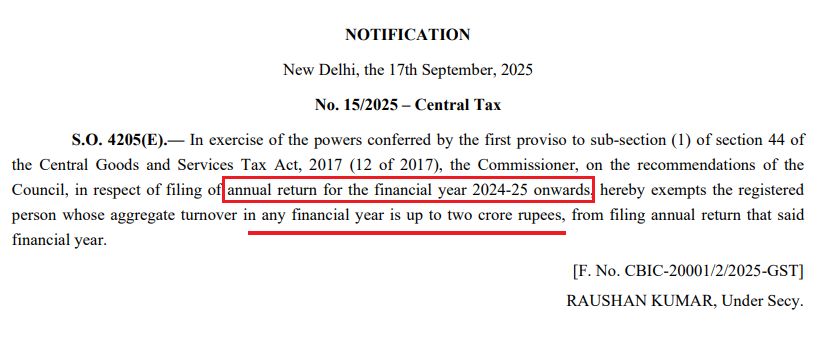

Taxpayers having aggregate turnover upto Rs.2 Crores are exempted from filing GSTR-9 from FY 2024-25 onwards vide Notification No.15/2025 - CT. All other taxpayers are required to file GSTR-9 for FY 2024-25.

Who is required to file GSTR-9C?

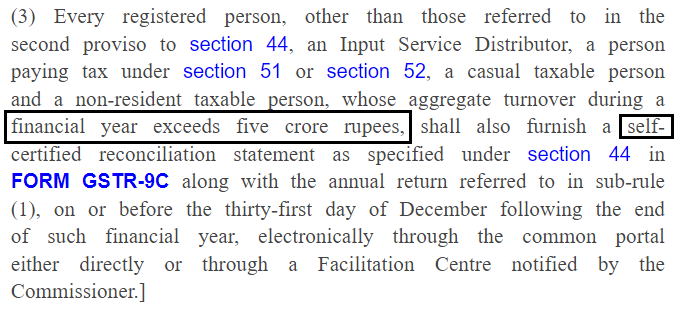

Taxpayers having aggregate turnover upto Rs.5 Crores are exempted from filing GSTR-9C for FY 2024-25 vide Rule 80(3) of CGST Rules. All other taxpayers are required to file GSTR-9C for FY 2024-25.

What is Aggregate Turnover?

“Aggregate Turnover” means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess;

What is Due date for filing GSTR-9 & GSTR-9C for FY 2024-25?

Due date for filing GSTR-9 & GSTR-9C for FY 2024-25 is 31st Dec 2025.

Prepared & Presented by:

Dr. Muhammed Mustafa C T

Senior Tax Consultant, BRQ Associates

???? +91 96331 81898

???? brqassociates@gmail.com

???? www.brqassociates.com

Disclaimer:

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any querys or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact are 9633181898. or via WhatsApp at 9633181898.