GST Advisory on Form GST DRC-03A: Linking Voluntary Payments with Demand Orders for Effective Closure

AUTHOR :Muhammed Mustafa C T

https://taxgtower.blog/brqblog/my_post_view/GST-Advisory-on-Form-GST-DRC-03A-Linking-Voluntary-Payments-with-Demand-Orders-for-Effective-Closure-1-660-423GST Advisory on Form GST DRC-03A: Linking Voluntary Payments with Demand Orders for Effective Closure

Introduction

On November 5, 2024, the Goods and Services Tax Network (GSTN) issued an advisory introducing Form GST DRC-03A, an enhancement aimed at addressing a common issue related to the closure of demand orders in taxpayers’ liability registers. This development follows Notification No. 12/2024 dated July 10, 2024, which formally introduced Form GST DRC-03A.

The advisory highlights cases where taxpayers had settled GST demand amounts using Form GST DRC-03 rather than the designated ‘Payment towards demand’ feature on the GST portal. As a result, although the payment was made, the corresponding demand order remained open in the electronic liability ledger. The introduction of Form GST DRC-03A aims to enable taxpayers to correctly link their voluntary payments to specific demand orders, ensuring the proper closing of these demands in their liability ledger.

Understanding the Key Features of Form GST DRC-03A

1. Purpose of Form GST DRC-03A

Form GST DRC-03A allows taxpayers to link their voluntary payments (previously submitted using Form GST DRC-03) to outstanding demand orders issued via notices such as DRC 07, DRC 08, MOV 09, MOV 11, or APL 04. This form helps bridge the gap between payment and demand closure, ensuring accurate reflection in the taxpayer’s electronic liability ledger.

2. Eligibility for Form GST DRC-03A

Only DRC-03 payments made under the payment categories of ‘Voluntary’ or ‘Others’ are eligible for adjustment using Form GST DRC-03A. Payments made under other causes in DRC-03 will not be considered for adjustment in DRC-03A.

3. Steps for Filing Form GST DRC-03A

To adjust an eligible DRC-03 payment against an outstanding demand order, taxpayers should follow these steps on the GST portal:

- Enter the ARN of DRC-03: Taxpayers are required to provide the ARN (Acknowledgment Reference Number) from the DRC-03 payment.

- Select Demand Order Number: Upon entering the ARN, the system will prompt taxpayers to select the appropriate demand order number from any pending demand.

- Auto-population of Information: Once the ARN and demand order number are entered, the system will auto-populate relevant details from both the DRC-03 form and the chosen demand order, making the adjustment process simpler and minimizing potential errors.

4. Automatic Update in Liability Ledger

Upon completion of the linking process, the system will automatically update the taxpayer\'s liability ledger to reflect the revised status of the demand order, effectively marking it as closed if the payment matches the demand amount.

5. Accessing Detailed Guidance and Support

Taxpayers can refer to a Detailed Advisory and FAQs available on the GST portal for step-by-step guidance on using Form GST DRC-03A. For additional support or technical issues encountered during the filing process, taxpayers can raise a service ticket under the category ‘DRC-03A-Filing’ on the Grievance Redressal Portal (https://selfservice.gstsystem.in).

Conclusion

The introduction of Form GST DRC-03A marks an important step in simplifying the payment and adjustment process for taxpayers. By enabling accurate closure of demand orders through linking voluntary payments with specific demand notices, GSTN aims to enhance transparency and efficiency in managing taxpayers\' liabilities. This measure helps ensure compliance and reduces discrepancies in the electronic liability ledger, reinforcing a smoother GST experience for taxpayers.

PROCESS OF FILING DRC-03A

PROCESS OF FILING DRC-03A

a. Login to the portal à Click on Services à User Services à My Applications à FORM GST

DRC-03A

b. Enter FORM GST DRC-03 number and click on the Search button. The following details related

to DRC-03 will be visible:

- Date of Filing

- Cause of Payment

- Period From & To

- FORM GST DRC-03 balance as on date

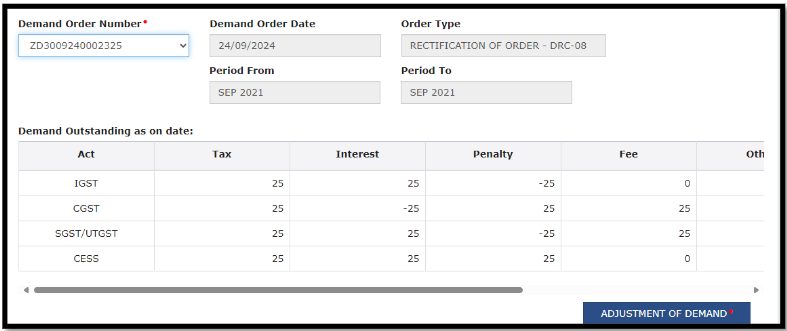

c. Select “ Demand Order No.” from the drop-down box. It will display all the outstanding

demands against which payment has not been done. Select the relevant Demand Order no.

from the drop-down box. On selection, following details will be displayed:

- Demand Order Date

- Order Type

- Period From & To

- Demand Outstanding as on date

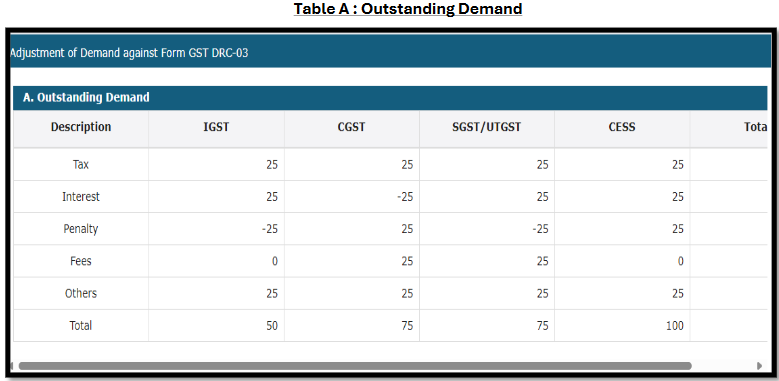

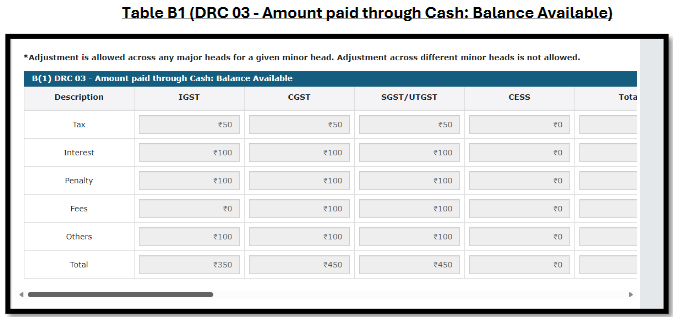

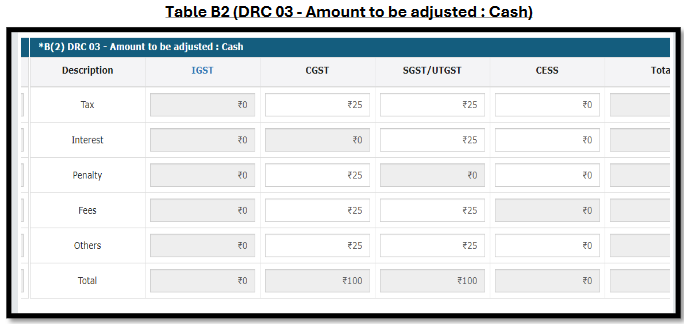

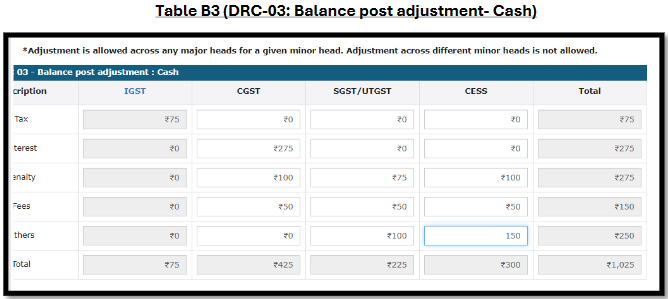

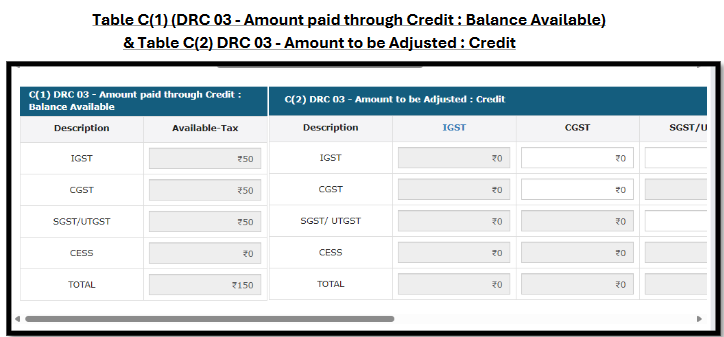

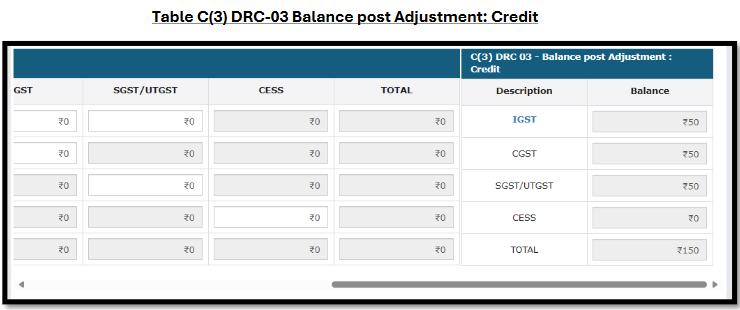

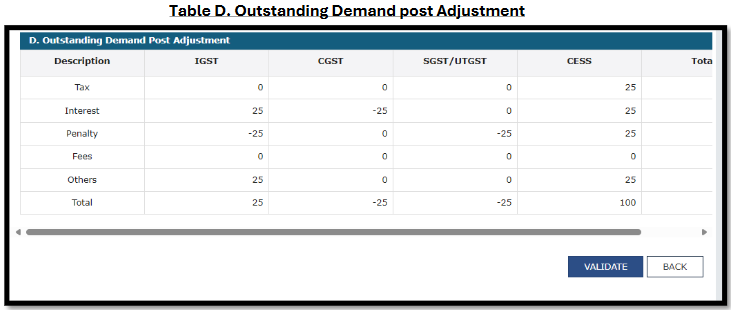

d. Taxpayer to click on the tab “Adjustment of Demand”. A new page will be opened and following tables will be displayed on the page. The taxpayer has to enter or edit the details shown in the tables below.

e. The details mentioned in Table A, B, C & D are to be verified by the taxpayer. After verification,

click on the Validate button.

f. Taxpayer can also upload any supporting document (if required). Subsequent to that, the

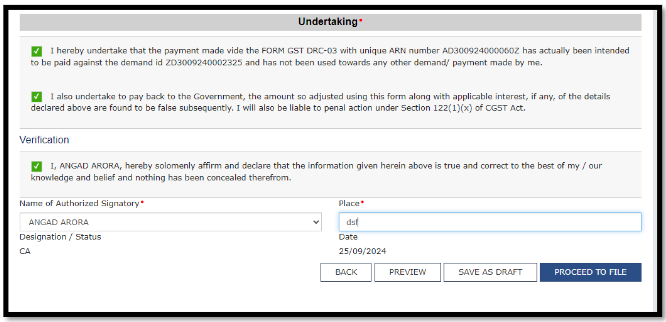

taxpayer has to sign the Undertaking & Verification as shown below

g. The taxpayer can then Preview or Save Draft or Proceed to file. After clicking on Proceed to

File button, the following page will be displayed and taxpayer can submit the form using

DSC/EVC.

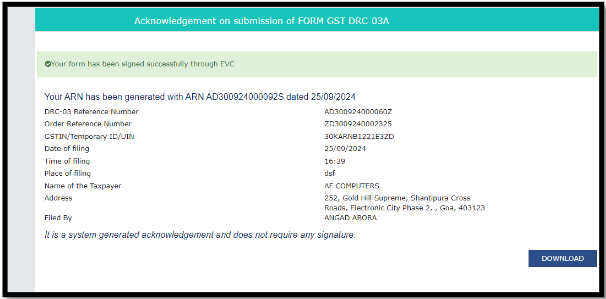

h. On successful submission, Acknowledgment will be issued

i. As per the details submitted in the DRC-03A form, corresponding entries will be posted into

ledger. Also, a single DRC-03 can be used to adjust payments against multiple demand

orders, and vice-versa.

j. In case of any technical issue, the taxpayer can raised a ticket on Grievance Redressal Portal

: https://selfservice.gstsystem.in

Disclaimer:

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any querys or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact are 9633181898. or via WhatsApp at 9633181898.