ITC Rules & Sale of Capital Goods / Fixed Assets under GST.

AUTHOR :Muhammed Mustafa C T

https://taxgtower.blog/brqblog/my_post_view/ITC-Rules-Sale-of-Capital-Goods-Fixed-Assets-under-GST--1-579-423ITC Rules & Sale of Capital Goods / Fixed Assets under GST.

Businesses use many capital goods for their operations. It is to be noted that tax paid on these capital goods can be availed as input tax credit.

Capital goods

Capital goods are assets such as buildings, machinery, equipment, vehicles and tools that an organization uses to produce goods or services. For example, a blast furnace used in the iron and steel industry is a capital asset for the steel manufacturer.

Difference between capital goods & other inputs

You are making a cake in your oven. You add ingredients such as eggs, water, flour, butter. These are your inputs. The cake is your final product. The oven is the capital good which helps you to make the cake. Inputs are consumed while making the final product and are treated as business expenses as cost of production.

Capital goods are not consumed when the final product is made. They are not consumed in a single year of production. Therefore, they cannot be entirely deducted as business expenses in the year of their purchase. Instead, they are depreciated over the course of their useful lives. The business recognises part of the cost each year through accounting techniques as depreciation, amortization and depletion.

When purchase capital goods the value of the goods ( if take ITC taxable value and not take ITC then net amount including GST ) show in the asset side of the balance sheet and the depreciation amount show in the expense side of the P&L account.

Input Tax Credit on capital goods

When you purchase anything, you are required to pay GST on it. Later, you can claim it as input tax credit on the GST paid on your purchases. Similarly, when you are purchasing any machinery for your factory, you will pay the applicable GST rate. This GST paid can be claimed as credit in the same way as inputs. However, No ITC will be allowed if depreciation has been claimed on the tax component of a capital good purchased.

Common credit

Businesses often use the same assets and inputs for both business & personal use. For example, Ms. Haritha is a freelance designer and blogger. She has a personal laptop which she also uses for her freelance work. She can claim the input tax credit of GST paid on purchase of laptop only to the extent it pertains to her freelance business. Ms. Haritha has also purchased a special designing software. Since this pertains only to her business, she can claim full ITC on this.

Why is common credit important

ITC is only available for business purposes. Many traders use the same inputs for both business & personal reasons. A taxpayer cannot claim any tax benefit of personal expenses. Again, goods exempted under GST already enjoy 0% GST.

ITC cannot be claimed for inputs used in such exempted goods as it will lead to negative taxation. So, ITC on inputs for exempted goods will also be removed.

The following calculations will help you to calculate the common credit that is attributable to personal supplies & exempted supplies leaving behind only the portion that pertains to taxable sales. Only that amount can be claimed as ITC. The credit that is attributable to personal supplies & exempted supplies must be reversed while filing GSTR-3B.

Capital goods used only for personal use or for exempted sales

No ITC is available for personal purchases or for capital goods used in exempted sales. This will be indicated in GSTR-3B and shall not be credited to the electronic credit ledger.

Example 1: Personal purchases

Ms. Haritha has purchased a fridge. Since this is not required for her business, i.e., a purely personal purchase, she will not be able to claim any ITC on the GST paid for the fridge.

Example 2: Capital goods used for exempted sales

Mr. Purushothama has purchased a small flour mill in his grocery shop to grind wheat grains to flour. Since he is producing unbranded flour it is exempted from GST. As it is an exempted sales, he cannot claim any ITC on the GST paid for the mill.

Capital goods used for normal sales

Sruthi has purchased machinery to manufacture shoes. Since, shoes are normal taxable supplies, the GST included paid while purchasing machinery will be completely available as ITC. This shall be indicated in GSTR-3B and shall be credited to the electronic credit ledger.

Common credit for Partly personal / Exempted and partly Normal sales

- The ITC paid for the capital goods will be credited to electronic credit ledger

- Useful life of such capital asset will be taken as 5 years from the date of purchase

- Now the total amount of input tax credited to electronic credit ledger for the whole useful life will be distributed over the useful life.

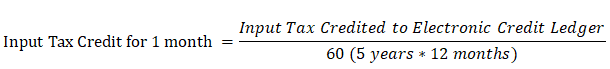

The useful life will be taken as 5 years. If you pay GST on a monthly basis then you will use the following formula:

Calculations for common credit

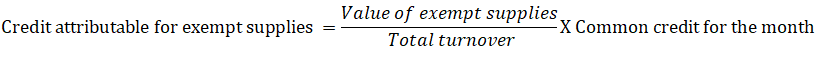

For exempted supplies

The amount of ITC attributable to exempt supplies out of common capital credit -

Remaining amount after deducting credit for exempt supplies will be allowed as ITC. All the above calculations must be done separately for:

- Central tax

- State Tax

- Union Territory Tax

- Integrated Tax

What happens if one starts using an asset for exempt goods also for taxable goods.

If a capital asset was earlier used exclusively used for:

- Personal purpose OR

- Selling exempted goods

And now it will is used commonly for:

- Business and personal purpose OR

- Affecting taxable and exempt supplies

Input tax to be credited to electronic credit ledger = Input Tax - 5% of Input tax for every quarter or part thereof from date of invoice.

Let us understand this via an example.

Mr. Purushothama bought a capital asset for use in exempt supplies only. He paid Rs 1,00,000/- along with GST of Rs 18,000 as input tax on 1st October 2017. On 15th November 2018, he wishes to use the capital asset commonly for both taxable and exempt supplies.

Now the eligible common input tax credit will be calculated as follows

Input Tax - 5% of Input tax for every quarter or part thereof

The no. of quarters from 1st October 2017 to 15th November 2018 = 5

i.e., 18,000 - (5% of 18000) * 5 quarters = 18,000 - 4,500 = 13,500

Now, this is the common credit available to Mr. Purushothama.

He will credit Rs 13,500 to Electronic Credit ledger. Now he will calculate the ITC attributable to exempt supplies as per the formula for exempt supplies.

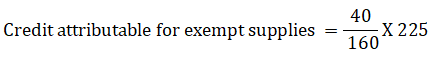

Common credit for one month= 13,500 ÷ 60 = 225 assuming his total turnover is Rs. 160 lakhs and exempted sales is Rs. 40 lakh-

Credit attributable for exempt supplies = (40 / 160) * 225 = Rs.56.25.

This amount of Rs.56.25 will be reversed in GSTR-3B under the ITC Reversal column.

Reversal of credit under certain circumstances

In the following circumstances the proportionate ITC will be reversed i.e. added to output tax liability in GSTR-3B:

- Where a normal taxpayer opts to pay tax under composition scheme or goods/services supplied by him become exempt

- In case of supply of capital goods or plant and machinery, on which input tax credit has been taken

- Every registered person whose registration is cancelled

Input tax credit involved in the remaining useful life in months shall be computed on a pro-rata basis, taking the useful life as five years.

Example:

Capital goods have been in use for 4 years, 6 month and 15 days.

Therefore, the useful remaining life in months = 5 months ignoring a part of the month

Input tax credit taken on such capital goods = C (say 10 lakhs)

Input tax credit attributable to remaining useful life = C *5÷60 = 10,00,000*5÷60 = 83,333

The above calculation must be done separately for integrated tax and central tax. This amount must be reversed in (i.e. becomes part of output tax liability) and furnished in:

Where a normal taxpayer opts to pay tax under composition scheme or goods/services supplied by him become exempt - Form GST ITC-03

Registration is cancelled - Form GSTR-10

This must be accompanied by a certificate from a practicing chartered accountant or cost accountant. In case of sale of capital goods, if the amount determined above is greater than the tax on transaction value of such sale, then the amount determined as above will be added to output tax liability. The details must be furnished in Form GSTR-1.

Capital goods send on job work

ITC will be allowed to the principal manufacturer if a capital asset has been sent to a job worker for job work.

Condition:

Such goods must be received back within a period of 3 years of being sent out.

Implications:

If the goods are not sent back within 3 years, it shall be treated as a deemed supply from the date of sending the goods and tax would be payable along with interest for late payment of taxes.

From the above calculations, it is clear that ITC Rules for common credit under GST have been meant to be followed strictly to avoid interest and other recovery mechanisms.

GST implication on Sale of Fixed Assets

Fixed assets are the assets or things purchased for a long-term purpose. In GST law, the term ‘Capital Goods’ is used for such fixed assets. As per section 2(19) of CGST Act, Capital goods mean goods, the value of which is capitalized in the books of account of the person claiming the input tax credit and which are used or intended to be used in the course or furtherance of business.

Chart on Applicability of GST on sale of Fixed Assets under different condition

Note 1:- Unintentional disposal means loss or damage of assets due to reasons such as accident, fire, natural calamity, theft etc, whereas sale or transfer of assets are considered as intentional disposal of Fixed Assets

Note 2:- The case where no consideration is involved must be discussed in the light of the amendment to the definition of Supply (Section 7 of the Act) made by the CGST Amendment Act, 2018. Before the amendment, if any transfer of capital assets was made under the direction of the person,(intentional transfer) the transaction was a supply under the provision of the Act, whether or not consideration was involved.

However, after the amendment, the requirement of consideration is a must. Therefore, it would be right to conclude that where no ITC has been availed, the transfer of capital goods without consideration shall not be a supply and hence no GST should be chargeable.

Note 3:- In case of unintentional disposal such as Damage/Lost Assets, Theft, ITC availed need to be reversed and will have to be paid as output tax liability. Valuation & determination of Tax payable:- As per sec 18(6) of CGST Act, the taxable amount will be:- an amount equal to Input tax credit attributable to remaining useful life OR the tax on the transaction value of such capital goods determined under section 15, whichever is higher

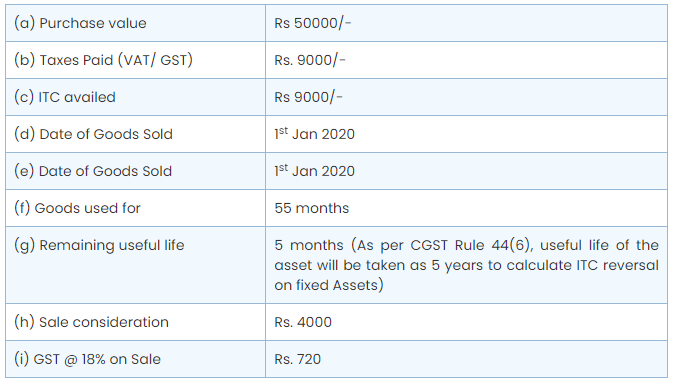

Example

Mr. Purushothama purchased Fixed Asset on 1st June 2015 (Pre GST), Even if he purchased the same Asset in Post GST Era, the methodology to calculate the taxable amount will remain the same.

Calculation of taxable amount:- Input tax credit attributable to the remaining useful life:-

(c*g/ 60) = 9000*5/60 = Rs 750

OR Tax on the transaction value of such Fixed Asset

4000*18% = Rs 720/-

Rs 750/- being higher of the two will be added as taxable value.

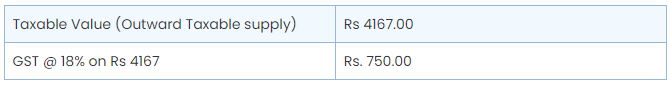

Invoicing and reporting in GSTR 1 when ITC attributable (ITC Reversal) to remaining useful life is higher than Tax on sale of Fixed Assets :-

ITC availed for remaining useful life of Fixed Assets amounting to Rs 750 /- need to be added as tax liability and reported in GSTR 1. However taxable value to be reported in invoice and GSTR 1 will be Rs. 4167. (750/18%=4167)

Invoice No......... Dt........

In simple words:

When sale of capital good ITC on which is already claimed and sale before completion of use full life (5year) If Tax on Book Value ( depreciated value as per balance sheet ) is higher than tax on sale value pay that amount GSTR-3B and show taxable vale as reversal amount / 18%.

Invoicing and reporting in GSTR 1 when Tax on transaction value is higher than ITC Reversal on account of sale of fixed asset

In such cases tax invoice has to be prepared and actual consideration will be the taxable value. Same has to be reported in GSTR 1., if sale value is Rs 5000/- and tax on transaction value is (5000*18%=900) higher than ITC attributable to remaining useful life ie Rs 750/-, (9000/60 x 5 = 750) Invoice will be prepared for (5000+900) 5900 /- and same is to be reported in GSTR- 1

In simple words:

When sale of capital good ITC on which is already claimed and sale before completion of use full life (5year) If Tax on Book Value ( depreciated value as per balance sheet ) is less than tax on sale value pay the tax on sale value through GSTR-3B and show the sales transaction value as taxable vale in GSTR-1

Outward Liability in case of Damage /Loss of those assets for which ITC has been availed

In case of unintentional transactions, such as Damage/Lost Assets, Theft, etc. tax on transactional value cannot be determined as there will not be any transaction value of damaged, lost capital goods Therefore amount towards ITC attributable on remaining useful life ie Rs 750 /- will have to be added as output tax liability. Taxable value to be reported in invoice and GSTR 1 will be Rs. 4167. (750/18%=4167). The amount shall be determined separately for an input tax credit of central tax, State tax, Union territory tax, and integrated tax

In case sale of capital goods in ITC which is not claimed.

In this case no need to compare sale value with book value show the taxable as the sale value of the capital goods in GST-1 and pay tax.

Margin Scheme for valuation of capital goods

The margin scheme is applicable for a dealer other than a person dealing in second-hand goods, only in the case of motor vehicles, that too only if input tax credit has not been claimed.

The scheme is made applicable to all taxpayers on the sale of the motor vehicle held as a capital asset. Vide https://drive.google.com/file/d/189dnKJemXQA7AmpGpjsDM71udoVoNjcI/view?usp=sharing - Central Tax (Rate) dated 25 Jan 2018. In this regard, GST has to be paid on the excess of selling price over the written down value as per the Income Tax Act, 1961, where depreciation has been claimed by the taxpayer. Where no depreciation has been claimed, GST shall be paid on the difference in the selling price and the purchase price.

Detailed analysis Margin Scheme Under GST

Margin scheme under GST helps avoid double taxation on the supply of goods which has been taxed already. Under Margin scheme, GST the supplier or the seller of the goods can calculate on the difference between the value of the supplied by the seller and the purchase value of the goods received by the customer.

Normally, as per valuation rules, GST is charged on the actual transaction value of supply of the goods, however, in respect of the second hand goods, a person dealing in such goods, may be allowed to pay tax on the margin. If there is no margin, then, no GST would be payable on such transaction. This is the basis of the GST margin scheme.

Valuation of Supply under the Margin Scheme

As per provisions of rule 32(5) of the CGST Rules, 2017, where a taxable supply is provided by a person dealing in buying and selling of second hand goods i.e., used goods as such or after such minor processing which does not change the nature of the goods and where no input tax credit has been availed on the purchase of such goods, the value of supply shall be the difference between the selling price and the purchase price and where the value of such supply is negative, it shall be ignored.

The proviso to the aforesaid rule further provides that in case of the purchase value of goods repossessed from a unregistered defaulting borrower, for the purpose of recovery of a loan or debt shall be deemed to be the purchase price of such goods by the defaulting borrower reduced by five percentage points for every quarter or part thereof, between the date of purchase and the date of disposal by the person making such repossession.

Margin Scheme has been introduced by Notification No. 10/2017- Central tax dated 28-06-2017 by making amendments in Rule 32(5) CGST Rules, 2017. Further, in the exercise of power given by Section 11 read with Section 15 of the CGST Act, the Government has issued Notification Number 08/2018-C.T.R., dated 25 January 2018 which provides for levy of GST at a concessional rate on margin amount in case of sale of second-hand motor vehicles. Further, the margin amount shall be the difference between the selling price and depreciated value calculated as per Section 32 of the Income Tax Act 1961 of the motor vehicle where depreciation on such motor vehicle has been claimed by the seller; and in other cases, it will be the difference between the selling price and purchase price.

Calculation of ‘Margin’ under Margin Scheme:

Margin on which GST would be charged shall be difference between sale price and purchase price of the goods. If such value is negative, then it shall be ignored. For example: - Raj & Sons is an antique dealer firm, registered under GST. It purchased an expensive painting for Rs. 2,00,000 and sold it to buyer for Rs. 5,00,000. The Margin will be Rs. 3,00,000 (Rs. 5,00,000- Rs. 2,00,000) being the difference between sale price and purchase price and applicable GST rate would be charged on margin of Rs. 3,00,000.

Tax Rate under Margin Scheme:

For second hand goods other than motor vehicles applicable rate in force shall apply as that of the goods when sold originally. However, for second hand motor vehicles tax rates have been provided under Notification 8/2018-Central Tax (Rate) which are as follows:

GST at the rate of 18% shall apply on petrol, LPG or CNG driven motor vehicles of engine capacity of 1200 cc or more and of length of 4000 mm or more

GST at the rate of 18% shall apply on diesel driven motor vehicles of engine capacity of 1500 cc or more and of length of 4000 mm

GST at the rate of 18% on Sports Utility Vehicles (SUV) & Utility Vehicles

GST at the rate of 12% for any other category of motor vehicles which are not covered above

Margin in case of other taxable persons selling old motor vehicles:

The above mentioned tax rates are also applicable to all taxable persons selling old vehicles which are their business assets. In this case, margin will be difference between sale price and depreciated value or purchase value calculated as per Section 32 of the Income Tax Act. However, concessional rates are not available if input tax credit under GST or Cenvat Credit or ITC under State VAT is availed.

Reverse Charge Mechanism (RCM) for Second Hand Goods:

The taxable person may purchase second hand goods from an unregistered person. However, he is not required to pay GST under RCM. Also, GST shall not apply if an individual (unregistered person) not in the course of business sells old goods.

Example for Margin Scheme

For example, XYZ, a car selling company, which deals in buying and selling of second hand cars, purchases a second hand car at Rs.5,00,000 from an unregistered person and sells the same after minor furbishing at Rs.5,75,000, exemption of GST shall for the purchased value of the vehicle. However, when XYZ, a registered user sold the same vehicle to a customer at the price value of Rs.5,75,000, GST shall apply to the difference amount i.e, Rs.75,000. Hence, GST applies only to the margin amount.

In case if the seller adds other value to the total amount by way of repair, refurbishing, reconditioning or other services, the seller shall add the expenses to the value of goods and should apply as part of the margin. If the unregistered user opts for the margin scheme for a transaction of second hand goods, then the person selling the car to the company would not issue any taxable invoice and the company purchasing the car cannot claim any input tax credit.

How to show sale of capital goods sales in P&L account and balance sheet

There 2 methods

First method

In case of sale of capital goods value is higher than book value then the difference amount show as income in the asset side of the P&L account as income from sale of capital goods and reduce the asset value from balance sheet.

In case of sale of capital goods value is less than book value then the difference amount show as expense in the expenditure side of the P&L account as loss from sale of capital goods and reduce the asset value from balance sheet.

Second method

In case purchase of new capital asset against the sale of old capital goods.

In case of sale of old capital goods value is higher than book value then don’t show the difference amount as income in the income side of the P&L account instead of that reduce the difference of book value & sale value of the old capital goods sold from the new asset value and capitalize the reduced value of new asset in the asset side of the balance sheet.

In case of sale of old capital goods value is less than book value then don’t show the difference amount as expense in the expenditure side of the P&L account instead of that increase the difference of book value & sale value of the old capital goods sold to the new asset value and capitalize the increased value of new asset in the asset side of the balance sheet.

Disclaimer:

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any querys or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact are 9633181898. or via WhatsApp at 9633181898.