Transfer of Input Tax Credit

AUTHOR :Muhammed Mustafa C T

https://taxgtower.blog/brqblog/my_post_view/Transfer-of-Input-Tax-Credit-1-485-423Transfer of Input Tax Credit

- Transfer Of ITC Between GSTINS within the same State in case of sale, merger, de-merger, amalgamation, lease or transfer of business.

A registered taxpayer can apply for transfer of matched input tax credit that is available in the Electronic Ledger to another business organization.

In case of transfer of business by way of sale of business, merger or demerger, a registered taxpayer can transfer the input tax credit unutilised and available in his electronic credit ledger into another business by filing a declaration in Form GST ITC-02. It must be filed by the transferor and action must be taken by the transferee. There is no time limit specified under the Act or Rules.

Need to file ITC-02

Multiple amalgamations, mergers, and demergers have taken place after the implementation of GST. In such cases, a transferor of business will have unutilised ITC lying in the electronic credit ledger. He can transfer this ITC to the new business only by filing GST ITC-02. On filing GST ITC-02, the unutilised credit of the transferor will get transferred to the electronic credit ledger of the transferee.

GST ITC-02 Filing

GST ITC-02 can be filed for transfer or matched input tax credit in case of the following circumstances:

- In case any registered institution undergoes sale, merger, de-merger, amalgamation, lease or transfer, the institution or organization must file an ITC declaration for transfer of ITC in the Form GST ITC-02.

- The acquired/ transferer institution should have matched Input Tax Credit available in the Electronic Credit Ledger, that is effective from the date of merger/ acquisition/ amalgamation/ lease/ transfer.

- The transferee and the transferor should have GST registration.

- It is mandatory for the transferor to file all GST returns in the past periods.

- All the pending transactions for the action of merging should either be accepted, rejected or modified and all liabilities of the returns filed by the transferor must be paid.

- The transfer of business has to be with an accurate provision of transfer of liabilities which will be the stayed demands of tax, or with any litigation /recovery cases. It has to be accompanied by the certificate that is issued by the Chartered Accountant or Cost Accountant.

Transfer of ITC

Given below are the ITC that can be transferred by filing the form GST ITC - 02.

- Matched ITC balance available in the transferor’s Electronic Credit Ledger.

- The ITC appearing under major heads such as Central tax, State/ UT tax, integrated tax, and CESS can be transferred by filing form GST ITC - 02.

Transfer of Matched Unutilized ITC by the Transferor

Given below are the steps to transfer the matched the unutilized ITC by filing Form GST ITC - 02.

Step 1:Log on to the official

The transferor or the acquiring entity has to log on to the GST Portal. The GST Home page is displayed.

Step 2:Enter the Credentials

The user has to enter all the credentials to log in to the GST Portal. The taxpayer’s dashboard gets displayed on the screen.

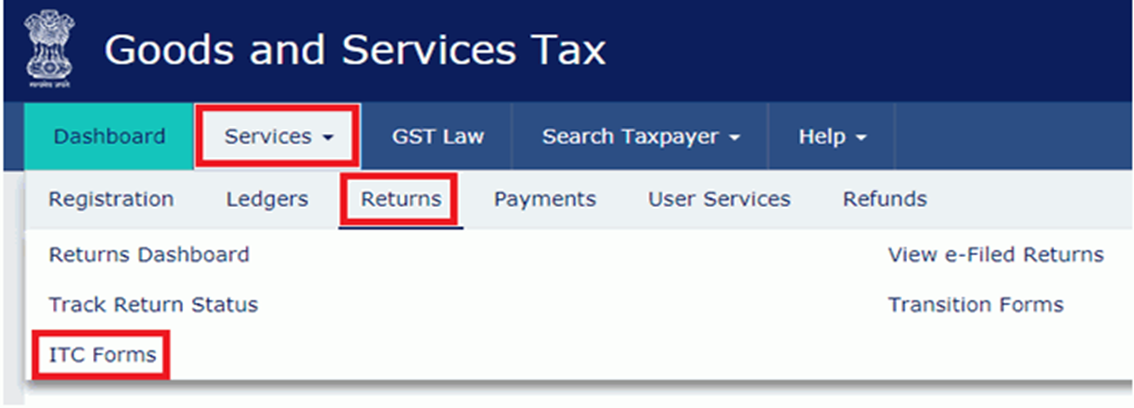

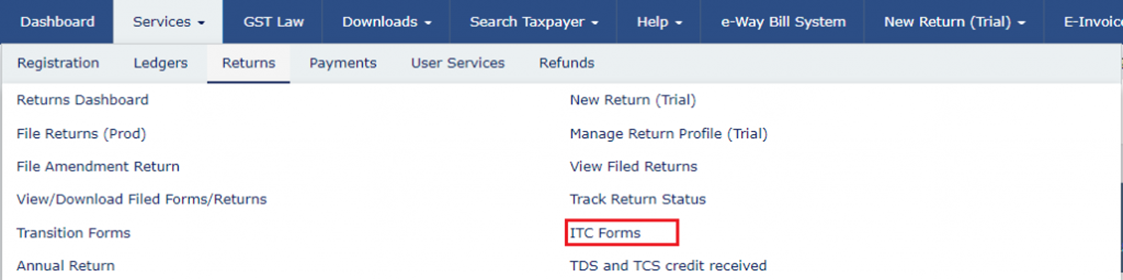

Step 3:Click on the ITC Forms

GO to Services tab, click on Return option an then click on ‘ITC Forms’. The GST ITC forms page is displayed on the screen.

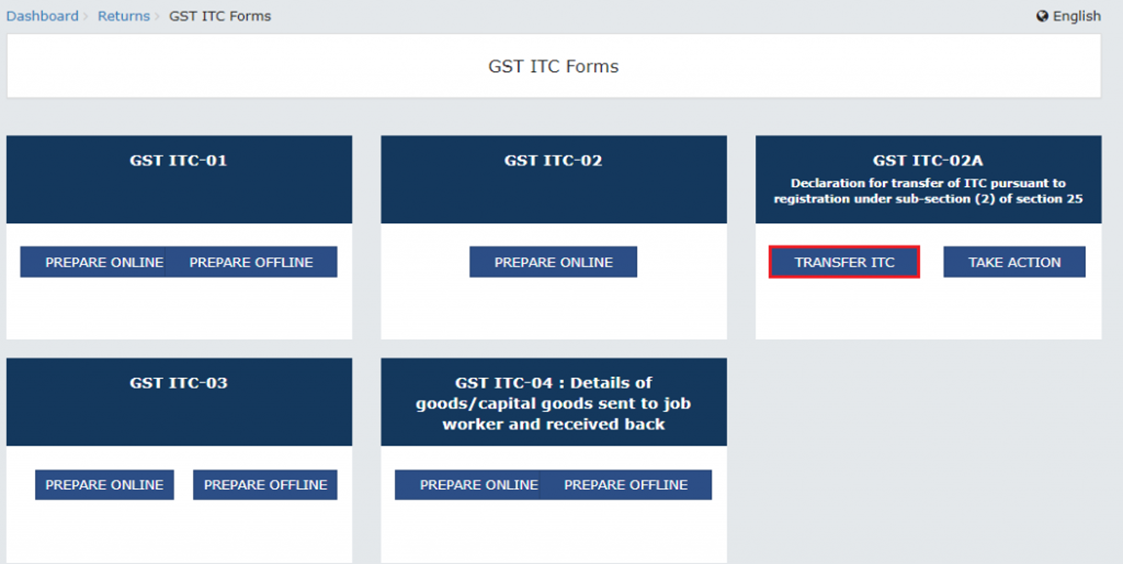

Step 4:Click on the Prepare Online button

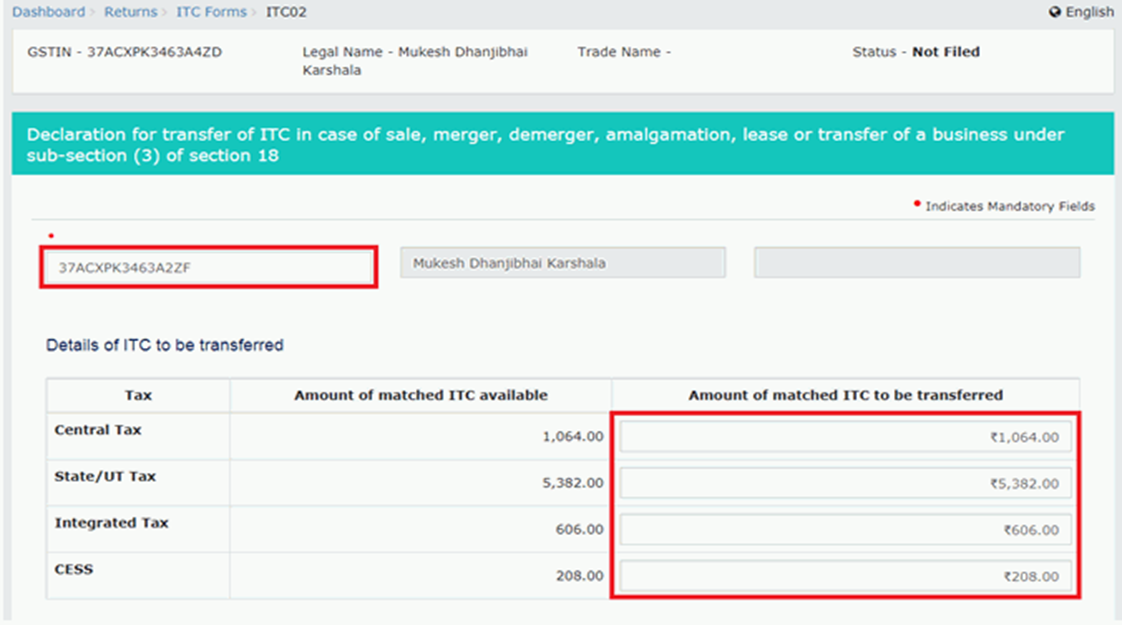

From the GST ITC - 02 tile, click on the Prepare Online option. The transferor has to choose to transfer all or partial ITC and has to fill the amount of matched ITC that has to be transferred.

Step 5:Enter the GSTIN

The transferor has to enter the GSTIN of the transferee. Following this, the amount of matched ITC to be transferred for each major head under the Details of ITC to be transferred section. The amount entered has to be less than or equal to the amount of ITC that is available in the Electronic Credit Ledger.

Step 6:Enter the details

Under section ‘Particulars of Certifying Chartered Accountant or Cost Accountant’, the following details have to be entered.

Name of the certifying accounting firm

Name of the certifying Chartered Accountant / Cost Accountant in the certifying firm

Membership number of the certifying firm

Date of the certificate issued by the certifying accounting firm

Step 7:Attach the Certificate

The transferor has to attach the copy of the certificate either in JPEG/ PDF format and the attachment should not exceed 500 KB.

Step 8:Click on Save

Click on ‘Save’ to upload the data and attachment to the GST Portal. The statement box given below has to be checked to declare that the furnished information is true and correct

Step 9:Select the Authorized Signatory

From the drop-down list, the authorized signatory has to be selected.

Step 10:File Form GST ITC - 02

Form GST ITC - 02 has to be filed using DSC or the EVC option. If the DSC option is selected, ensure that it is signed using the DSC of the selected authorised signatory. If EVC option is selected, the system sends an OTP to the authorized signatory’s registered mobile number that has to be entered in the pop-up after selecting this option.

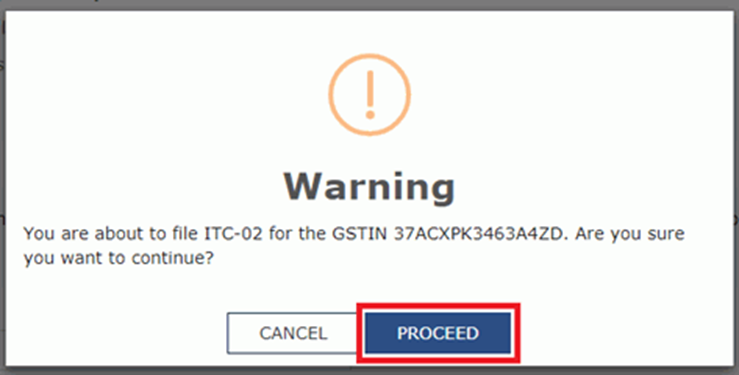

Step 11:Click on Proceed option

The Proceed option has to be clicked on the Warning pop-up message.

Step 12:Enter the OTP

An OTP is sent that has to be entered and then click on Verify option.

Once it is verified, the displays a confirmation message on the successful filing of the Form GST ITC - 02. This confirmation also contains the system generated ARN. A copy of the form GST ITC - 02 can be downloaded by clicking on the Downloads button.

Transfer of Matched Unutilized ITC by the Transferee

Once the transferor has filed Form GST ITC - 02 to transfer the matched unutilized ITC, the transferee needs to login to the GST Portal and has to either accept or reject the ITC transfer. Here are the steps to process the ITC transfer.

Step 1:Login to the Portal

The transferee has to login to the GST Portal and is required to enter the credentials.

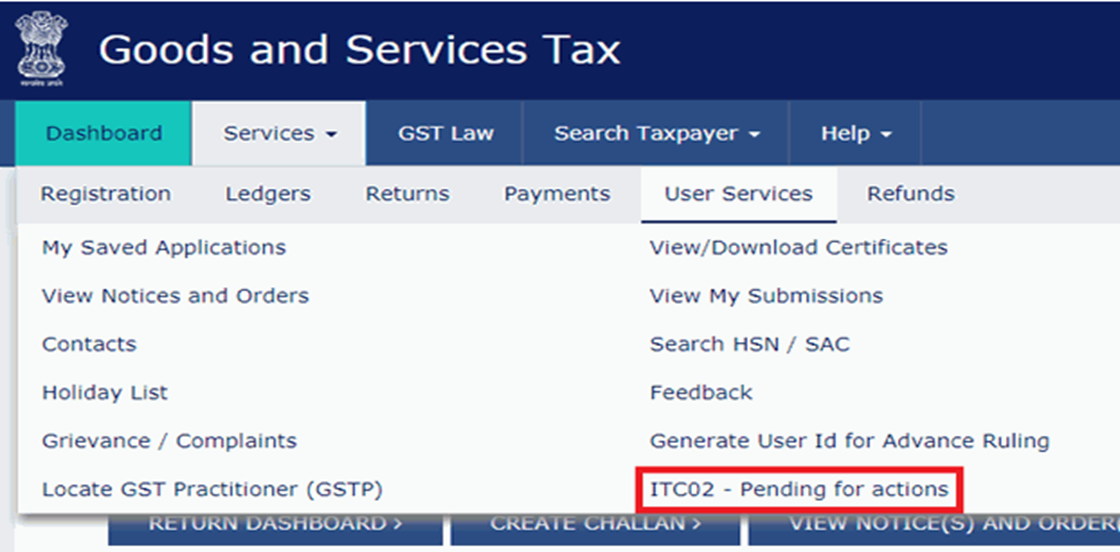

Step 2:Click on ITC 02

From the Servies tab, click the ‘User Services’ and then select ‘ITC 02 - Pending for actions’ options.

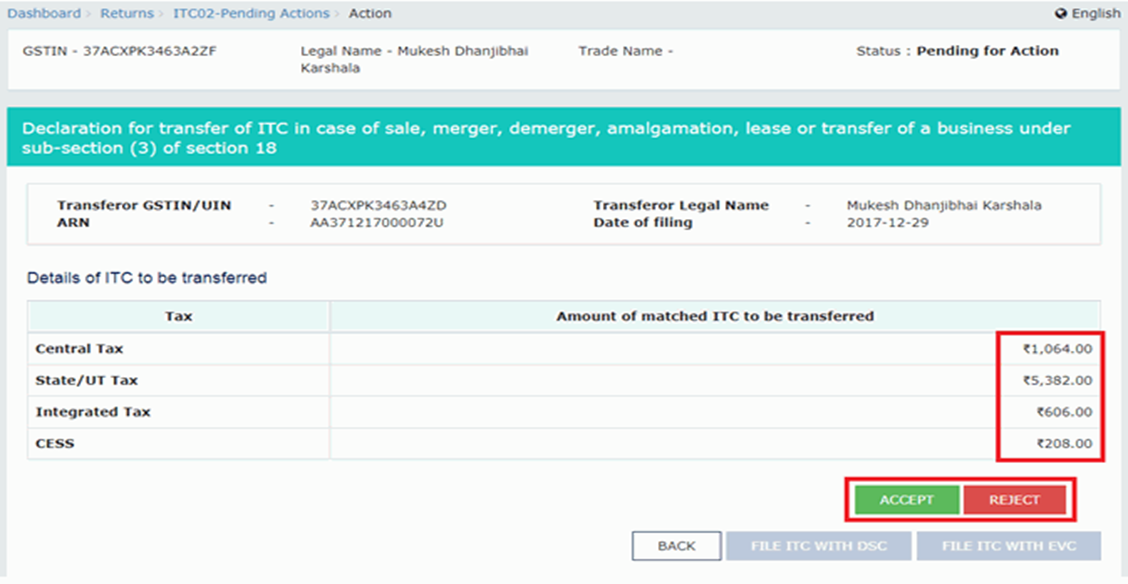

Step 3:Click the ARN

The transferee is directed to a new page from which the user has to click on the ARN link.

Step 4:Accept/ Reject

By clicking on the ARN link, details of all the matched ITC to be transferred against the major head will be displayed. The user has to either accept or reject the request.

Step 5:Accepting the Request

If the request has been accepted, the system displays a confirmation message and then prompts the user to proceed with filing the response.

Step 6:Check the Declaration Statement

The declaration statement given below has to be checked to state that the information is true and correct.

Step 7:Select the Authorized Signatory

From the drop-down list, the authorized signatory has to be selected.

Step 8:Filing the Form

The form has to be filed using DSC or the EVC option. If the DSC option is selected, ensure that it is signed using the DSC of the selected authorised signatory. If EVC option is selected, the system sends an OYP to the authorized signatory’s registered mobile number that has to be entered in the pop-up after selecting this option.

Step 11:Click on Proceed option

The Proceed option has to be clicked on the Warning pop-up message.

Step 12:Enter the OTP

An OTP is sent that has to be entered and then click on Verify option.

Once it is verified, the system displays a confirmation message on successfully completing the ITC transfer process. This confirmation page also contains the system generated ARN.

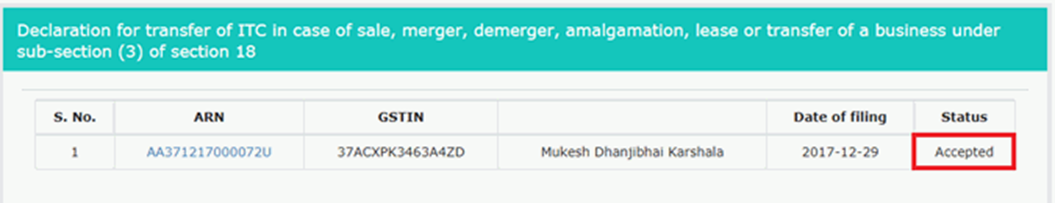

Step 13:Click the option Back

By clicking on the option ‘Back’, the user returns to ITC-02 Pending for actions screen. The transferee can now view the changed status Accepted.

Pursuant to transfer of business unit, unutilised ITC under different heads can be transferred to other states by filing ITC 02 - authority for advance ruling, andhra pradesh vide AAR No.05/AP/GST/2020. Dated 24.02.2020.

The Authority for Advance Ruling, Andhra Pradesh (AAR) has recently passed an order1 allowing interstate transfer of unutilised input tax credit (ITC) pursuant to supply of business unit as going concern.

Facts of the case

The applicant had transferred its entire business operation in the state of Andhra Pradesh including its capital assets as a going concern to its other business unit in Karnataka for a consideration. In this regard, the applicant filed an application before the AAR to seek a ruling on the following

1. Whether the transaction of sale of the business would amount to supply of goods or supply of services?

2. Whether the applicant can claim the benefit of exemption notification no. 12/2017-Central Tax (Rate) dated 28 June 2017, wherein by virtue of entry no. 2 specific exemption has been granted for services provided by way of transfer of going concern? and

3. Whether the applicant can transfer the unutilised ITC to unit located in Karnataka?

AAR’s order

As per entry 4(c) of schedule II of the CGST Act, 2017, transfer of business assets is treated as ‘supply of goods’. However, since in the instant case the business is transferred/sold in its entirety, including capital assets, it cannot be grouped under ‘supply of goods’.

Further, since the definition of services qualifies ‘anything other than goods’ as services, transfer of business as going concern would automatically fall under the ambit of ‘supply of services’.

Further, the description of services under Sl.No.2 of Chapter 99 of Notification No. 12/2017 - Central Tax (Rate) dated 28.6.2017 provides for "Services by way of transfer of a going concern, as a whole or an independent part thereof" as nil rated, the transaction is not liable to tax.

On the question of transfer of the unutilised ITC under different heads i.e. CSGT, SGST and IGST, the AAR referring to the provisions contained under Rule 41 of the CGST Rules read with Section 18(3), held that the transferor can transfer unutilised ITC to the transferee, which is lying in its electronic credit ledger by filing form GST ITC-02.

It is pertinent to understand the circumstances under which, the Input tax credit can be transferred. As per Section 18(3) of the CGST Act, when there is a change in the constitution of a registered person on account of sale, merger, demerger, amalgamation, lease or transfer of the business, the said registered person shall be allowed to transfer the input tax credit which remains unutilised in his electronic credit ledger to such sold, merged, demerged, amalgamated, leased or transferred business in such manner as may be prescribed. In the instant case, the AAR ruled that the said transfer from one place to another is an activity covered under Sl.No.2 of chapter 99 of Notification No.12/2017- Central Tax (Rate) dated 28.6.2017, i.e Services by way of transfer of a going concern, as a whole or an independent part thereof and permitted the transfer of ITC. However, the transfer in the instant case was not the transfer envisaged in the CGST Act. In the author’s opinion, the word transfer from one place to another has been misinterpreted and equated to transfer from one person to another.

In the instant case, even though the two GSTIN are considered as distinct persons under the CGST Act, the GSTIN is obtained using the same PAN and hence do not necessarily create a change in the constitution of the registered person as per Section 18 or change in the ownership of business as per Rule 41 of the CGST Rules.

Also, if the said transfer of ITC from one state to another is permitted vide ITC-02, it means that the credit accumulated from the tax paid to the State Government of Andhra Pradesh can be used/set off against the tax that is liable to paid to the State Government of Karnataka.

Our comments

Though there are several AARs wherein the sale of the business as going concern has been held to be exempt from levy of GST. However, in the instant case, the order by AAR is unique in two ways, one it has allowed sale of business to its another unit located in another state and second, it has allowed the transfer of ITC from one state to another.

Also, if the said transfer of ITC from one state to another is permitted vide ITC-02, it means that the credit accumulated from the tax paid to the State Government of Andhra Pradesh can be used/set off against the tax that is liable to paid to the State Government of Karnataka. Such an interpretation would be completely against the premise under the entire GST Law is drafted. The CGST Act and the Rules drafted thereof are implemented in such a way that there is no cross utilization of revenue between the States. It is for this very reason why the form ITC -02 does not permit transfer of Inter-State ITC and allows only if the GSTIN of both the transferor and the transferee belong to the same state.

For instance, a Tamil Nadu registered entity, ABC Pvt Ltd., receives services from a Hotel XYZ Pvt Ltd., registered in the state of Karnataka. ABC Pvt Ltd., would receive only a CGST & SGST Invoice, as the place of supply of services rendered by XYZ Pvt Ltd., would be the place where the immovable property is located. In such a case, ABC Pvt Ltd., would not be eligible to use/utilise the CGST & SGST on the said invoice, even though the said invoice is auto populated in their GSTR-2A and fulfils the conditions under Section 16. This is so because the ITC accruing to the registered person is from a state where he has not obtained any registration. In such a circumstance, credit from a state accrued due to the payment of taxes from that state cannot be used for setting the tax liability arising in another state. Such a cross utilization of ITC was not envisaged under the GST law because the state government’s revenue in such an instance would be affected tremendously. Therefore, transfer of ITC from one state to another via ITC-02 is not a legal/possible transaction envisaged under the CGST Act/CGST Rules.

If the transfer and cross utilization between the ITC of two different states are permitted, then, it’ll also disturb the compensation payable to the State government as per the “Goods & Services Tax (Compensation to States) Act 2017.

Further even Section 20 of the CGST Act, does not enable an ISD to transfer the credit of one state to another. This is clearly to ensure that the revenue accruing to one state in terms of tax has to be in accordance to the ITC that the state has provided to the tax payer.

Therefore, in case of transfer of business or sale, demerger etc between entities located at two different states, the ideal way would be to terminate the registration in one state and get a refund of the unutilized ITC or cross charge the other entity and transfer the ITC. An alternative under ITC-02 is not a viable option for consideration. At the outset, as per the GST provisions, the transfer of ITC between two GSTINs can happen only if the transaction under Section 18 occurs between two entities located in the same state and not otherwise.

Transfer of ITC between GSTINs within the same State

Under the GST law, different business establishments within the same state can either be declared as an ‘additional place of business’ by amending the registration of the principal place of business or obtain separate GST registration.

In case a new registration is taken, the establishment would have a separate GSTIN and a different record of the electronic ledgers/registers under the GST law.

Let us look at how this new establishment can avail ITC initially with the following topics:

What is Form ITC-02A and who should use it?

The principal place of business (transferor) can transfer any unutilised balance of input tax credit to a new branch (transferee) in the ratio of the value of assets within a period of 30 days from obtaining the new registration. The value of assets is to be considered irrespective of whether or not ITC has been availed thereon. The transfer of ITC is to be done by the filing of Form GST ITC-02A by the transferor.

Purpose of using Form GST ITC-02A

The method of ITC transfer is similar to the distribution of ITC by ISD, but within the same state/Union Territory and based on asset distribution.

It is possible that before a branch is set up within the same state, the capital goods, inputs or input services meant for that new branch are purchased by the head office (principal place of business). In such a case, the principal place of business would have already claimed ITC on such capital goods, inputs or input services.

Such ITC claims ideally belong to the branch since it ultimately consumes or uses the capital goods, input services or inputs. Thus, the Form GST ITC-02A is used to transfer such unutilised ITC to the newly established branch.

It also contains a table showing the details of ITC to be transferred, as given below:

- Tax/Cess: Values of tax/cess will have to be filled.

- Amount of matched ITC available: The amounts in this column are auto-populated.

Having unutilised balance in the Electronic Credit is not merely enough. The same should also be matched, i.e., the respective supplier should also upload the invoice details in GSTR-2A against which ITC is claimed.

The ITC rules allow the claim of ITC only to the extent of eligible ITC in GSTR-2B. Such ITC cannot be transferred.

- Amount of matched ITC to be transferred: The amount of ITC to be transferred must be calculated as per the ratio of the value of assets as mentioned earlier and then entered in this column.

How to file Form GST ITC-02A on the GST portal?

The transferor of ITC must follow the below steps.

Step 1: Log in to the GST portal with valid credentials and navigate to the ITC-02A page.

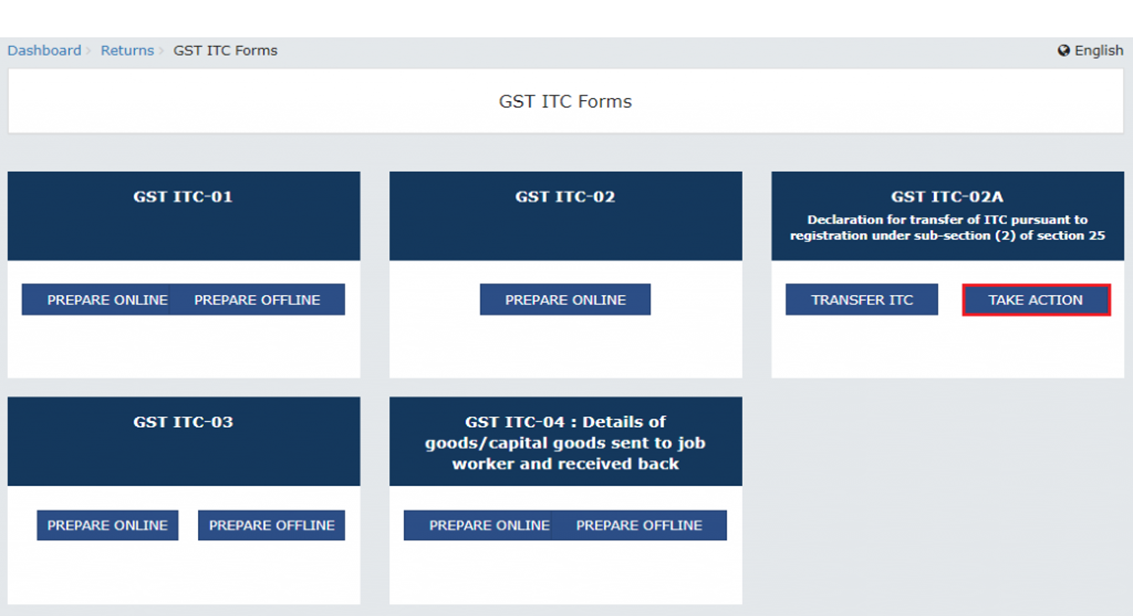

From the homepage, go to Services > Returns > ITC Forms

The page on ‘Declaration of transfer of ITC in case of obtaining separate registration within a State or Union Territory’ is displayed.

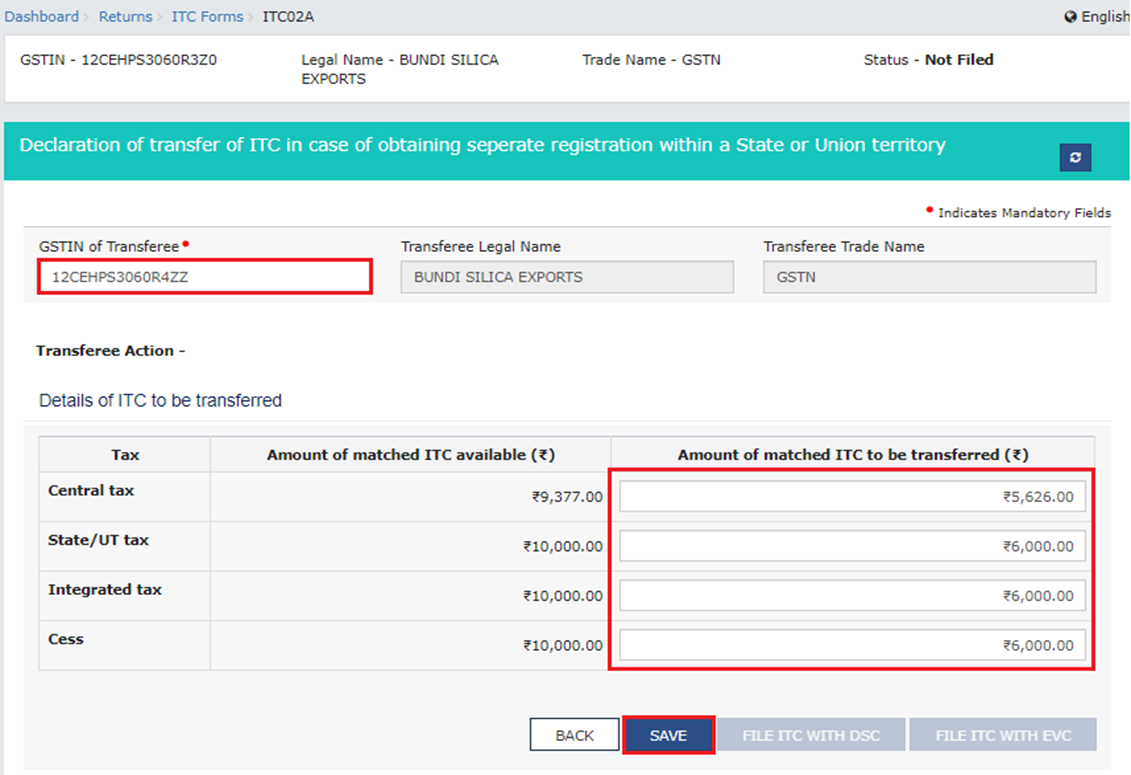

Step 2: Enter the necessary details of ITC to be transferred.

Enter the GSTIN of the transferee. It will auto-populate the ‘Transferee Legal Name’ and ‘Transferee Trade Name’. Enter the amounts in the ‘Amount of matched ITC to be transferred’ column and click on ‘Save’.

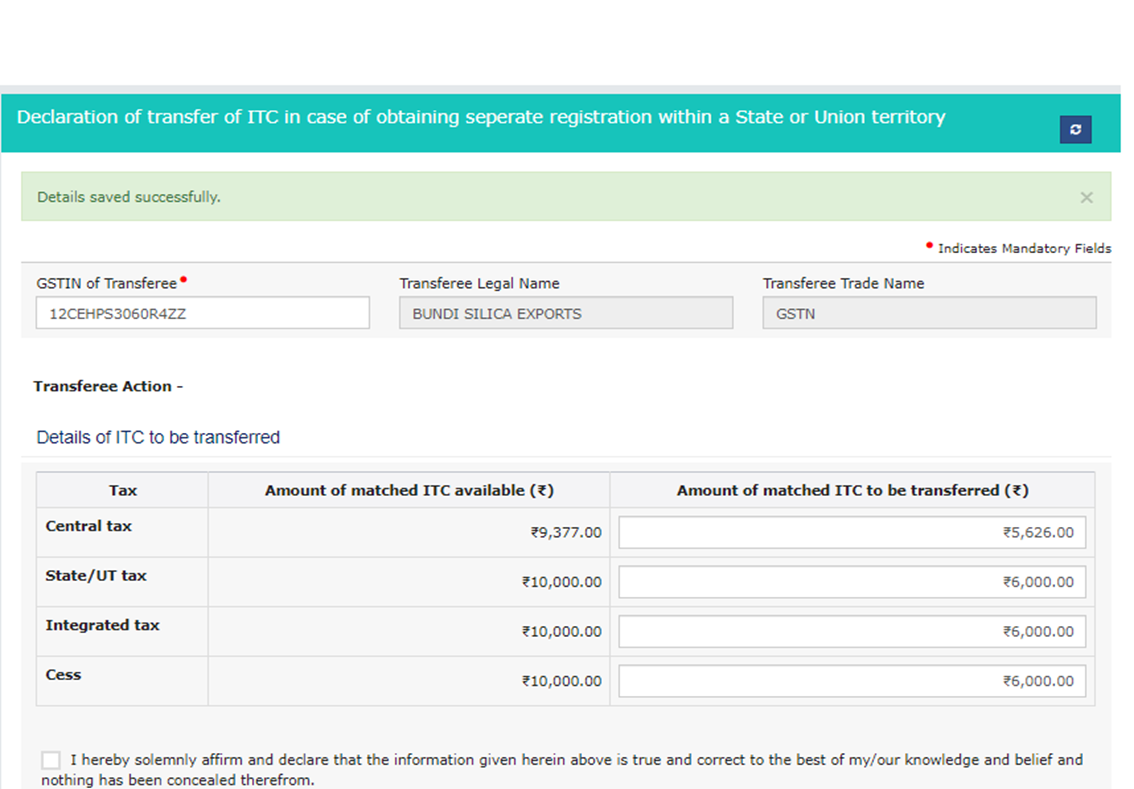

A confirmation message saying ‘Details saved successfully’ will be displayed.

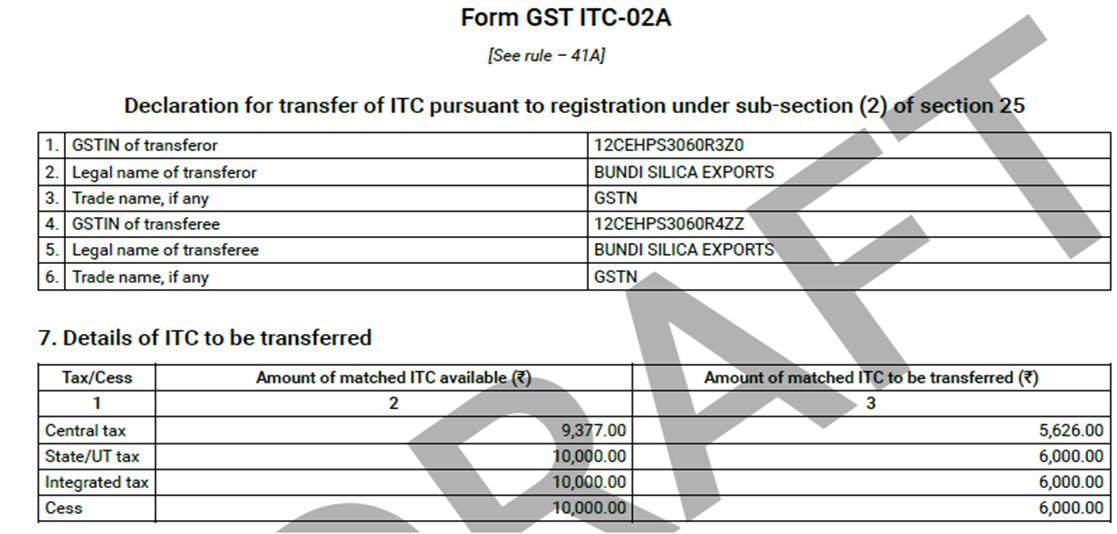

Step 3: Preview form ITC-02A before filing.

Click on the ‘Preview Draft GST ITC-02A (PDF)’ button to view the filled-up draft form.

The summary page will be displayed as shown below.

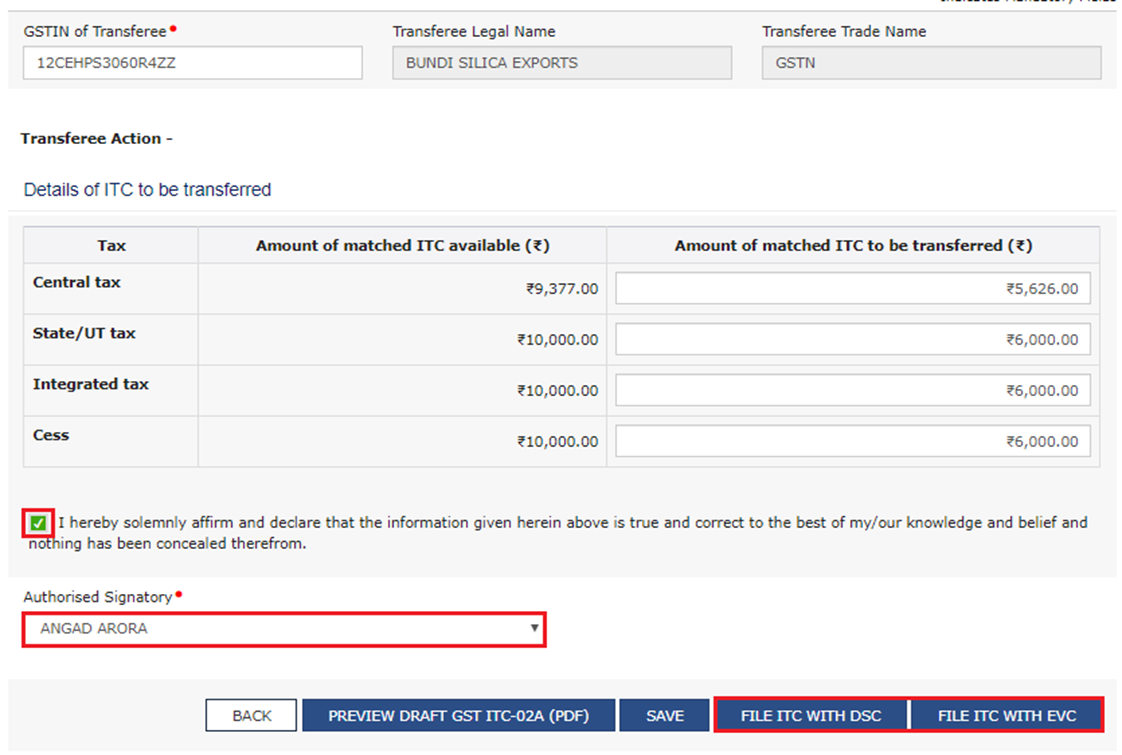

Step 4: File Form ITC-02A either using EVC or DSC.

Choose the declaration checkbox. Select the authorised signatory from the drop-down list and click on the ‘File ITC with EVC’ or the ‘File ITC with DSC’ button, whichever applicable.

If ‘File ITC with DSC’ button is selected, choose the digital signature and click on the ‘Sign’ button.

If ‘File ITC with EVC’ is selected, enter the OTP sent on the registered email address and mobile number.

A warning message will be displayed. Click on ‘Proceed’.

A message confirming successful submission appears along with the ARN. The filed form can also be downloaded in PDF format.

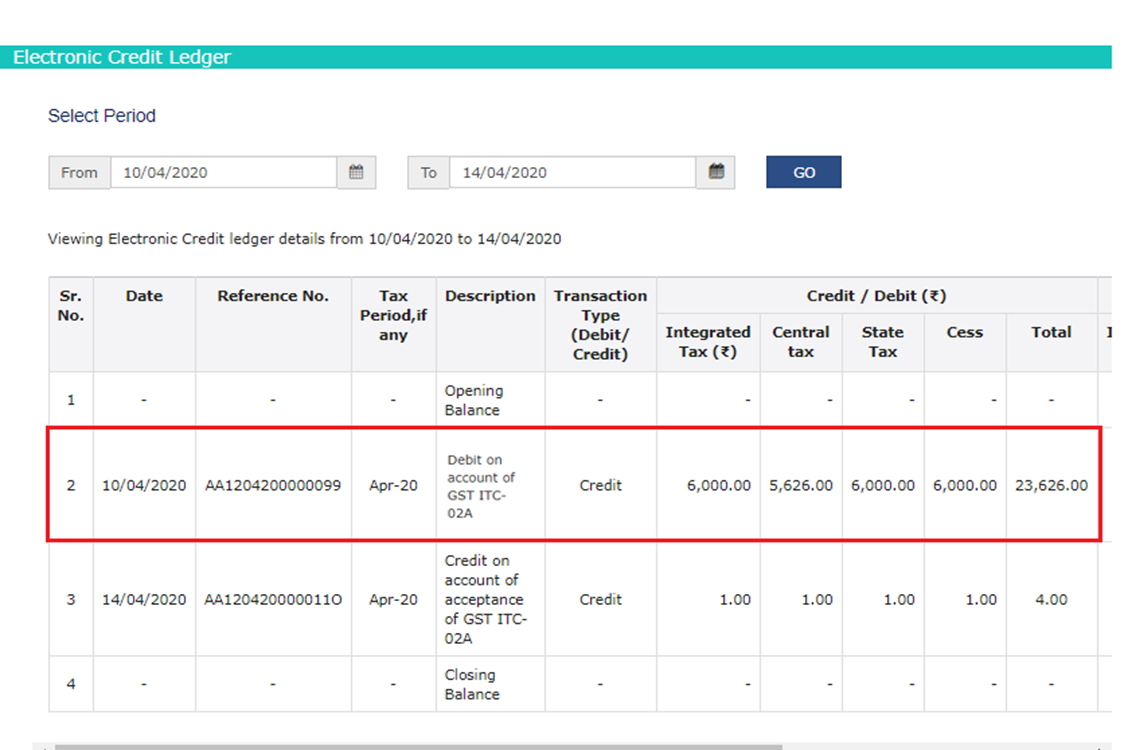

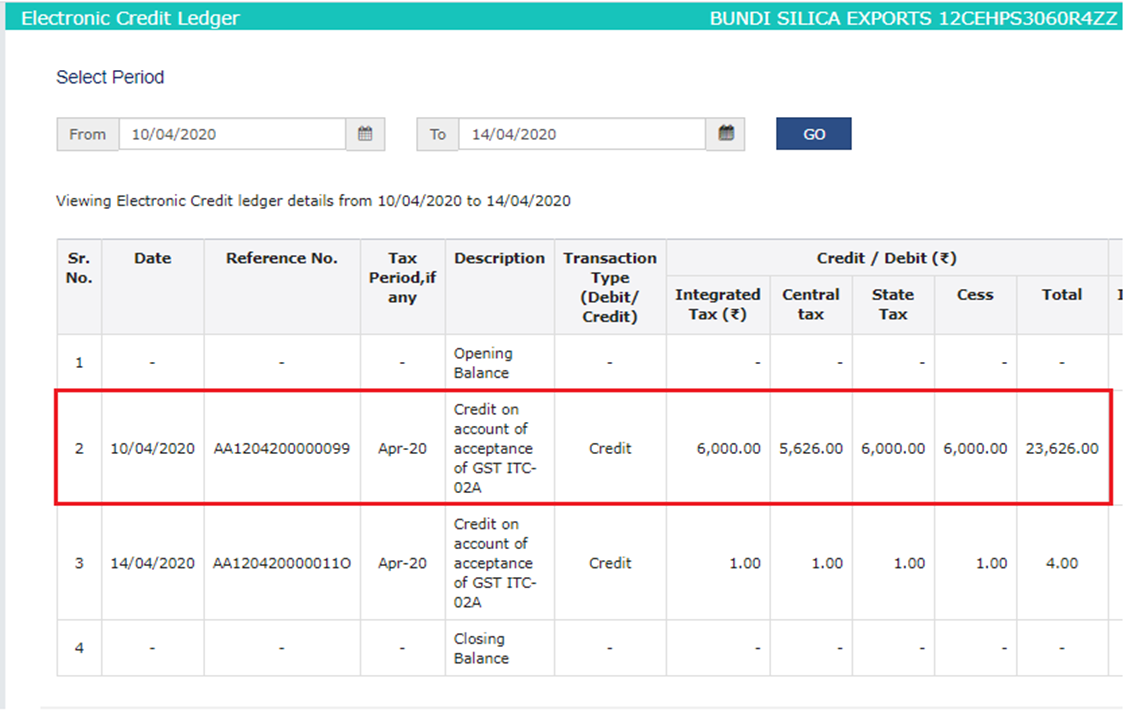

The Electronic Credit Ledger will be debited with the amount of transfer.

What should be done after filing Form GST ITC-02A?

Upon the successful filing of ITC-02A, an email and SMS notification will also be automatically sent to the transferee (branch). The branch can either accept or reject the transfer following the below steps.

Step 1: Log in to the GST portal with valid credentials.

From the homepage, Go to Services > Returns > ITC Forms

Step 2: Take action by either accepting or rejecting the ITC transferred to you after due verification.

Click on the ‘Take Action’ button under the ‘GST ITC-02A’ tile.

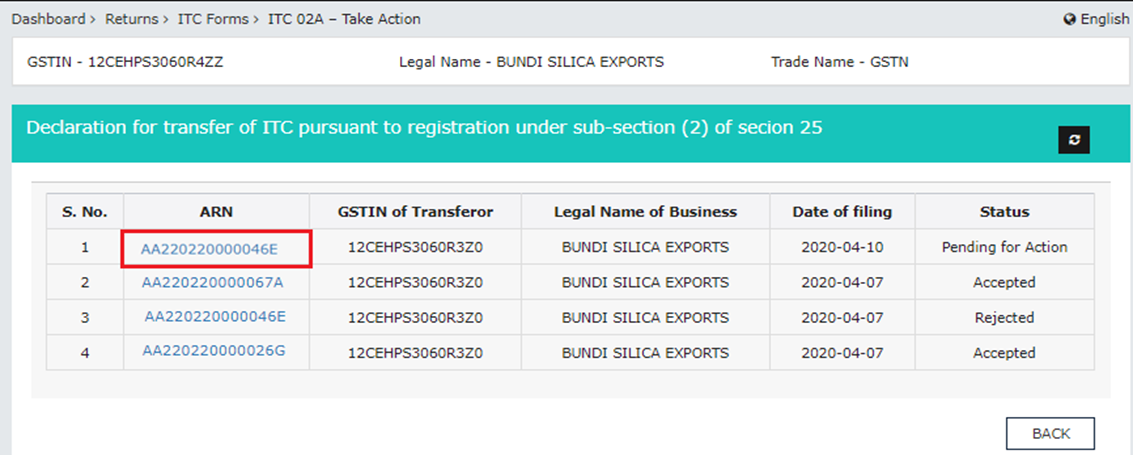

Choose the applicable ARN, that is pending for action. There is a complete list of ARNs displayed with status as ‘Accepted’, ‘Rejected’ or ‘Pending for Action’.

The following details must be verified by the transferee GSTIN:

- Transferor entity’s GSTIN/UIN, legal name and date of filing ITC-02A and ARN.

- Amount of matched ITC being transferred as entered by the transferor.

The transferee should verify the details provided and click on the ‘Accept’ button if they are in order. If they are not, click on the ‘Reject’ button.

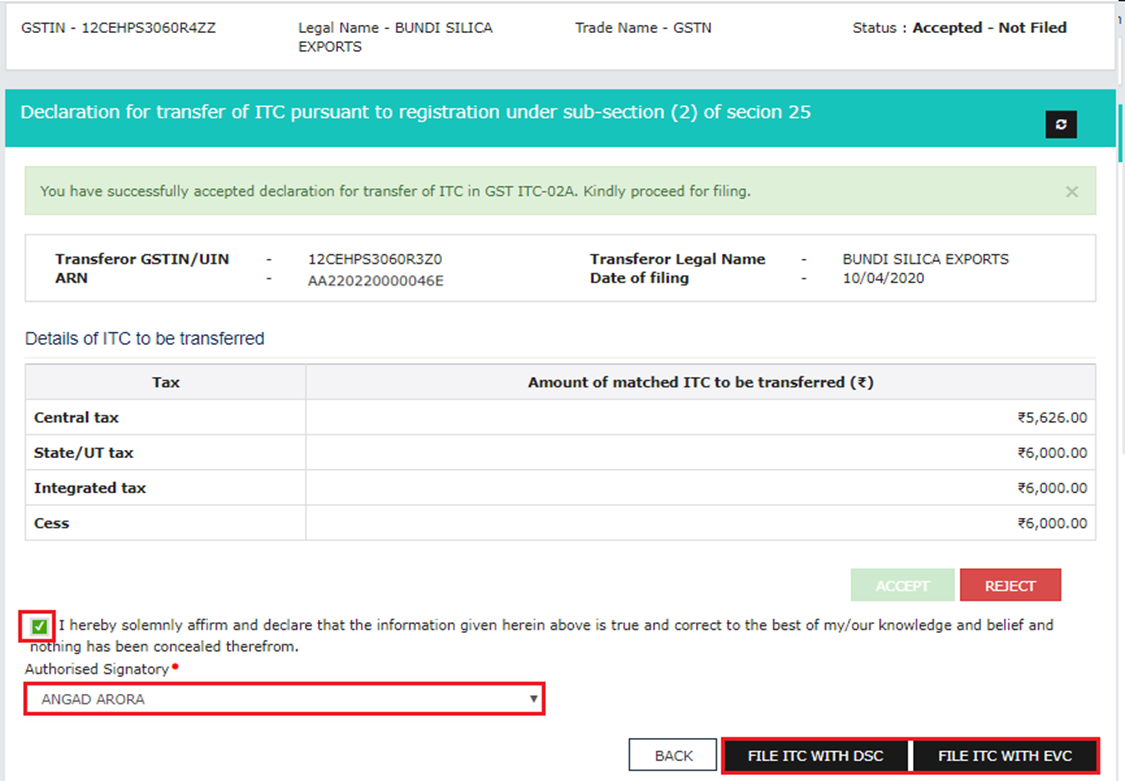

If accepted, the confirmation message will be ‘You have successfully accepted declaration of transfer of ITC in GST ITC-02A. Kindly proceed for filing.’

If rejected, the confirmation message will be ‘You have rejected the declaration of transfer of ITC in GST ITC-02A. Kindly proceed for filing.’

Step 3: Submit the declaration for ITC transferred through ITC-02A

Select the declaration checkbox. Select the authorised signatory from the drop-down list and click on the ‘File ITC with EVC’ or the ‘File ITC with DSC’ button, whichever is applicable.

If the ‘File ITC with DSC’ button is selected, choose the digital signature and click on the ‘Sign’ button.

If ‘File ITC with EVC’ is selected, enter the OTP sent on the registered email address and mobile number. A warning message will be displayed. Click on ‘Proceed’.

The success message along with the ARN will be displayed. The filed form can also be downloaded in PDF format. The transferor will be notified of the response by email and SMS.

If Accepted:

The Electronic Credit Ledger of the transferee will be credited as shown below:

If Rejected:

The amount of ITC will not be transferred to the transferee and the same will be re-credited to the Electronic Credit Ledger of the transferor as follows:

Cash Transfer between different GSTINs registered on common PAN within the same State or in the different state.

PMT 09 Cash Transfer between different GSTINs registered on common PAN

A functionality has been provided on the Portal for the taxpayer to transfer their amount lying in cash ledger across GSTINs registered on the same PAN, using Form GST PMT-09.

Only two major heads i.e., IGST and CGST are available in Form GST PMT-09 to transfer amount to different GSTINs registered on common PAN.

This is in addition to the existing functionality wherein taxpayers can transfer the amounts from one head to another head for the same GSTIN.

Disclaimer:

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any querys or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact are 9633181898. or via WhatsApp at 9633181898.