Two-factor Authentication on GST Portal To Login From 01 Dec 2023.

AUTHOR :Muhammed Mustafa C T

https://taxgtower.blog/brqblog/my_post_view/Two-factor-Authentication-on-GST-Portal-To-Login-From-01-Dec-2023--1-452-423GSTN Advisory -Two-factor Authentication on GST Portal To Login From 01 Dec 2023.

GSTN is introduced two-factor authentication (2FA) for taxpayers to strengthen the login security in GST portal.

The pilot rollout has been done for a state of Haryana and working seamlessly. Currently, 2FA will be rolled out for Punjab, Chandigarh, Uttarakhand, Rajasthan and Delhi in 1st phase. In 2nd phase, it is planned to be rolled out all states across India.

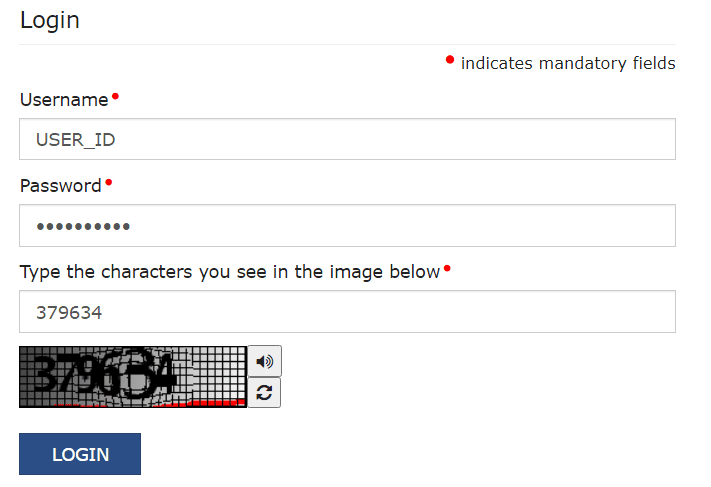

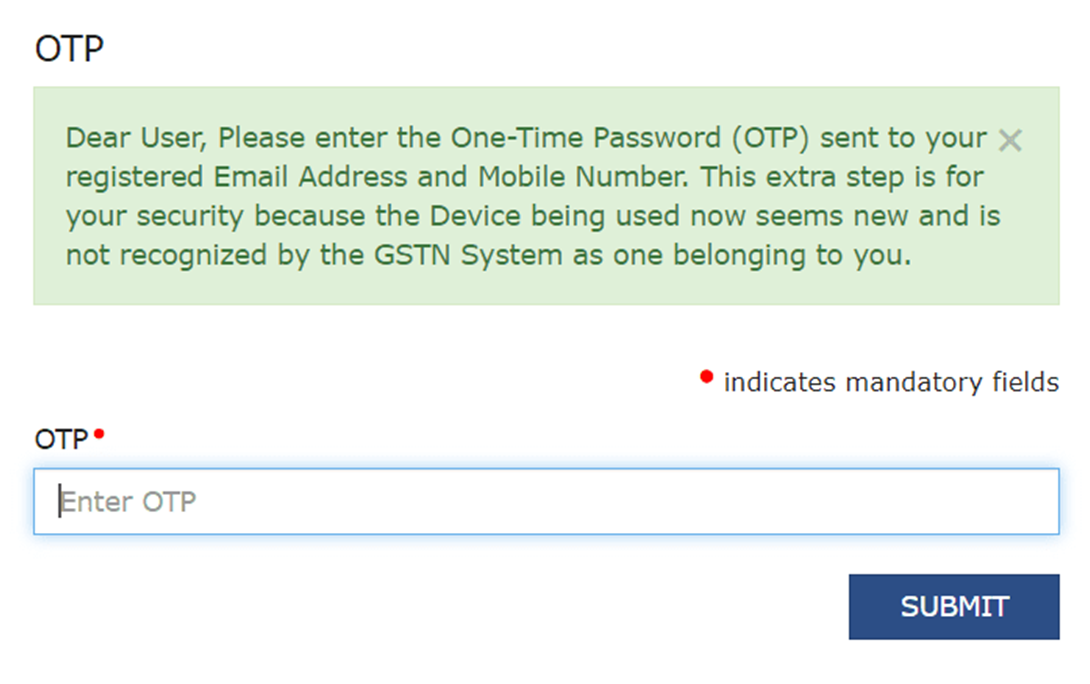

Taxpayers would need to provide one-time password (OTP) post entering user id and password, the OTP will be delivered to their Primary Authorized Signatory “Mobile number and E-mail id”.

This OTP would only be asked, in case the tax-payer changes the system (desktop or laptop or browser) and location

Author's Suggestion

Tax-payers and their auditors, tax practitioners , accountants are advised to keep the tax payers email and mobile number of authorized signatory updated on the GST Portal for receiving the OTP communication for GST portal Login.

Disclaimer:

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any querys or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact are 9633181898. or via WhatsApp at 9633181898.