Income Tax Computation For Individuals: Rules And Rates

AUTHOR :Muhammed Mustafa C T

https://taxgtower.blog/brqblog/my_post_view/Income-Tax-Computation-For-Individuals-Rules-And-Rates-1-291-423Income Tax Computation For Individuals: Rules And Rates

The calculation of tax liability depends on several factors, including an individual%u2019s residential status, sources of income, and the tax regime they choose.

Computation of Tax for Individual

The income taxable in the hands of an individual and tax liability thereon shall be computed according to his\her residential status. The income taxable under the Income-tax Act is computed under the five heads of income, and tax thereon is computed as per the tax slab rates applicable for that previous year.

Determination of residential status

Income-tax liability of an individual is calculated on the basis of his %u2018Total Income%u2019. His\Her residential status in India influences the income to be included in the taxable income.

Every year the residential status of the taxpayer is to be determined by applying the provisions of the Income-tax Law designed in this regard and, hence, it may so happen that in one year the individual would be a resident and ordinarily resident and in the next year he may become non-resident or resident but not ordinarily resident and again in the next year his status may change or may remain same.

An individual can be categorized into the following residential status during the previous year:

(a) Resident in India\ Ordinarily resident in India

Resident in India

Individuals are deemed to be residents of India under Section 6(1) of the Income Tax Act if they meet the following conditions: If he/she stays in India for 182 days or more in a fiscal year, or if he/she stays in India for 60 days or more in a fiscal year, and if he/she stays in India for 365 days or more in the four years immediately before the previous year and comes under ordinary resident in income tax.

Ordinarily resident in India

A resident individual will be treated as resident and ordinarily resident in India during the year if he satisfies both the following conditions:

(1) He is resident in India for at least 2 years out of 10 years immediately preceding the relevant year.

(2) If he or she spends 730 days or more in India in the seven years preceding the current year

(b) Resident but Not-ordinarily Resident

When an assessee meets the following fundamental requirements, he or she will be regarded as RNOR: If an individual stays in India for a time of 182 days or more in a fiscal year; or if he/she stays in India for a period of 60 days in a fiscal year and 365 days or more in the four preceding fiscal years.

An Assessee, on the other hand, will be classified as a Resident but Not Ordinarily Resident (RNOR) if they meet one of the following fundamental conditions:

If he/she stays in India for 730 days or more in the previous fiscal year.

If he/she was a resident of India for at least 2 out of 10 days in the previous fiscal year.

(c) Non-Resident in India

An individual will be eligible for Non-Resident (NR) status if he or she meets the following criteria:

If an individual spends less than 181 days in India within a fiscal year.

If an individual stays in India for no more than 60 days in a fiscal year.

If an individual stays in India for more than 60 days in a fiscal year but does not remain for 365 days or more in the preceding four fiscal years.

An individual, who is a resident in India, is liable to pay tax in India on his global income. On the other hand, a non-resident person is liable to pay tax in India only on that income which accrues or arises or is deemed to

accrue or arise in India, and income received or deemed to be received in India. However, if the income of an individual is taxable in India and outside India, then he can claim a foreign tax credit in respect of such income.

Computation of income

Income tax is levied on the total income of an individual. Thus, the first step is to compute the total income. The total income of an assessee is computed in the following steps:

Calculate income under 5 heads

In Income-tax Act, the income is computed in the following 5 heads of income:

- Salary

- House Property

- Profits and gains from business or profession

- Capital Gain

- Income from Other Sources.

Clubbing of income of any other person

An individual is generally taxed in respect of his own income, but in respect of certain income, the Income-tax Act clubs the income of other persons in an individual%u2019s income. Hence, an individual has to add another person%u2019s income to his own income if clubbing provisions apply in his case.

Set off and carry forward of losses

Where an individual has incurred losses under any head of income, then he is allowed to make the following adjustments subject to relevant provisions relating to set-off and carry forward of losses:

- Intra-head adjustment to set-off of losses from one source of income against income from another source taxable under the same head of income.

- Inter-head adjustment to set-off of losses from one head of income against income taxable under another head of income.

If losses cannot be set off in the same year due to inadequacy of eligible profits, then certain losses are carried forward to the next assessment year.

Allowability of deductions under Chapter VI-A

The aggregate of income so computed as per aforesaid steps is called %u2018Gross Total Income (GTI)%u2019, out of which various deductions are allowed to a taxpayer on account of investments and savings made by him.

Determining total income

The balance income after allowing the deductions is called %u2018Total Income%u2019. The total income is bifurcated into 2 parts %u2013 Normal Income and Special Income. The normal income of a taxpayer is charged to tax as per applicable tax rates, and special income is charged to tax at special rates.

Computation of tax

To calculate an individual%u2019s tax liability, income shall be first apportioned into normal income and special income. The bifurcation is done as normal income is taxable at applicable slab rates. However, where an individual opts for New Tax Regime as provided under Section 115BAC, the tax on normal income shall be charged at the rates provided under the said section. Whereas special income is taxed at special rates as prescribed under the Act.

An individual is liable to pay tax on normal income only if it exceeds the maximum exemption limit.

Applicability of AMT

Every assessee (other than a company) is subject to Alternative Minimum Tax (%u2018AMT%u2019) if he has claimed any of the following deductions:

- Deduction under any provision (other than Section 80P) included in Chapter VI-A under the heading %u2018C- Deduction in respect of certain income%u2019; or

- Deduction under Section 10AA; or

- Deduction under Section 35AD.

The alternative minimum tax is payable by the individual if the adjusted total income exceeds Rs. 20 lakhs and the tax payable by him on his total income (computed as per normal provisions of the Act) is less than 18.5% (or 9% in case of a unit in IFSC) of %u2018adjusted total income%u2019.

Computation of tax liability on total income | Amount |

AMT liability | |

Tax payable on deemed total income computed as per AMT provisions | xxx |

Add: Surcharge | xxx |

AMT after surcharge | xxx |

Add: Health and Education Cess | xxx |

Total tax payable as per AMT provisions (A) |

|

Normal tax liability | |

Tax on income at normal rates | xxx |

Tax on income at special rates | xxx |

Tax on Total Income | xxx |

Less: Rebate under Section 87A | xxx |

Tax payable after rebate | xxx |

Add: Surcharge | xxx |

Tax payable after surcharge | xxx |

Add: Health and Education Cess | xxx |

Total tax payable as per normal provisions (B) | xxx |

Gross tax payable [Higher of AMT liability (A) or Normal tax liability (B)] Less: Tax- deferred on perquisite value of ESOPs issued by eligible start-ups | xxx (xxx) |

Gross tax payable (after excluding tax-deferred on perquisite value of ESOPs issued by eligible start-ups) Less: %u2013 AMT Credit %u2013 Relief under Section 89 %u2013 Foreign tax credit under Section 90, 90A or 91 | xxx (xxx) (xxx) (xxx)

|

Net tax liability Add:%u2013 Interest under Section 234A, 234B, 234C- Fees for late filing of return under section 234F | xxx xxx xxx |

Aggregate tax liability Less: Taxes Paid%u2013 TDS deducted- TCS collected- Advance tax paid- Self-Assessment Tax | Xxx (xxx) (xxx) (xxx) (xxx) |

Total tax payable/ refundable | xxx |

Tax Rates for Individual

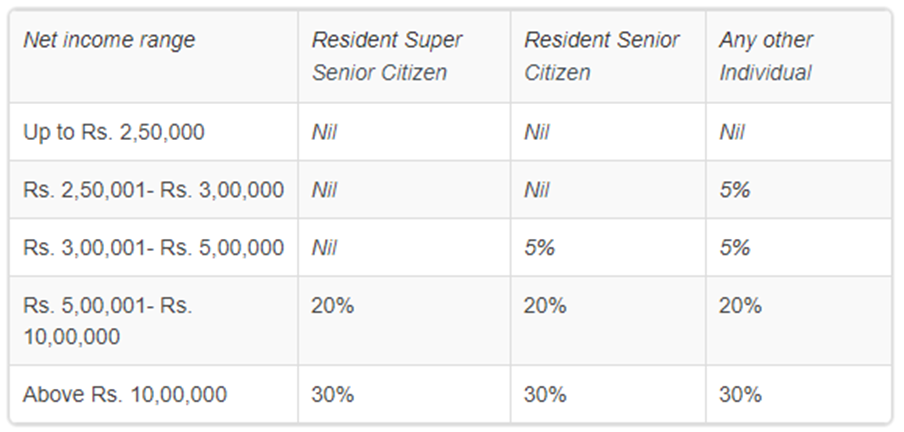

Normal Tax Rates (Old tax regime)

The normal tax rates are prescribed every year under the First Schedule of the Finance Act. The tax rates in the case of an individual have been enumerated in the below table:

Super senior citizen%u2019 means an individual whose age is 80 years or more at any time during the relevant previous year.

%u2018Senior citizen%u2019 means an individual whose age is 60 years or more at any time during the relevant previous year but less than 80 years on the last day of the previous year.

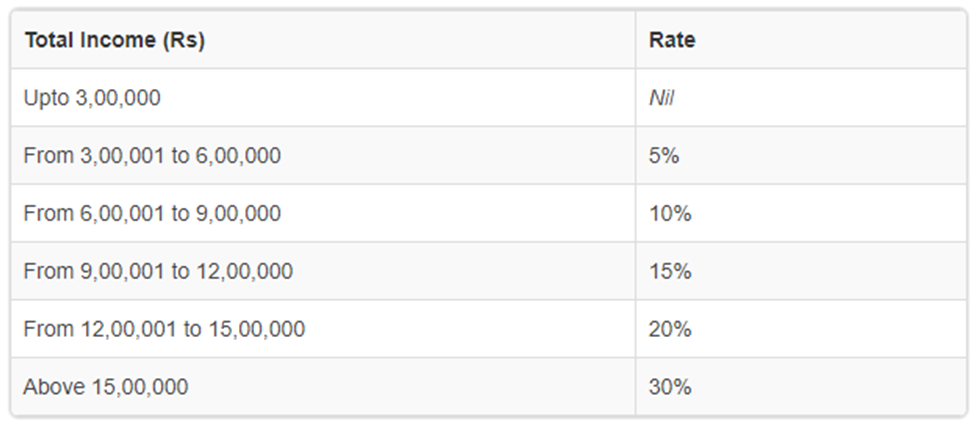

Normal Tax Rates (New tax regime)

Section 115BAC provides a new tax regime for individuals, which has reduced tax slabs. However, to avail of the benefit of this tax regime, the assessee has to forgo specified exemptions and deductions.

If an eligible assessee opts for this regime, the income shall be taxable at the following rate:

The assessee opting for payment of taxes under Section 115BAC is required to satisfy the following conditions:

- Total income of the assessee has to be computed without claiming the following specified exemptions and deductions;

- Leave Travel concession [Section 10(5)];

- House Rent Allowance [Section 10(13A)];

- Official and personal allowances (other than those as may be prescribed) [Section 10(14)];

- Allowances to MPs/MLAs [Section 10(17)];

- Exemption for income of minor [Section 10(32)];

- Deduction for units established in Special Economic Zones (SEZ) [Section 10AA];

- Entertainment Allowance [Section 16((ii)];

- Professional Tax [Section 16(iii)];

- Interest on housing loan (In case of property referred under section 23(2) i.e. self-occupied house property) [Section 24(b)];

- Additional depreciation in respect of new plant and machinery [Section 32(1)(iia)];

- Deduction for investment in new plant and machinery in notified backward areas [Section 32AD];

- Deduction in respect of tea, coffee, or rubber business [Section 33AB];

- Deduction in respect of business consisting of prospecting or extraction or production of petroleum or natural gas in India [Section 33ABA];

- Deduction for donation made to approved scientific research association, university, college, or other institutes for doing scientific research which may or may not be related to business [Section 35(1)(ii)];

- Deduction for payment made to an Indian company for doing scientific research which may or may not be related to business [Section 35(1)(iia)];

- Deduction for donation made to a university, college, or other institution for doing research in social science or statistical research [Section 35(1)(iii)];

- Deduction for donation made for or expenditure on scientific research [Section 35(2AA)];

- Deduction in respect of capital expenditure incurred in respect of certain specified businesses, i.e., cold chain facility, warehousing facility, etc. [Section 35AD];

- Deduction for expenditure on agriculture extension project [Section 35CCC]; and

- Deduction under Sections 80C to 80U other than specified under Section 80JJAA, Section 80CCD(2), Section 80CCH(2), and Section 80LA(1A) [Chapter VI-A].

(b) Total income of the assessee has to be computed without set-off of losses or depreciation carried forward from earlier years if such loss or depreciation is attributable to any of the specified exemptions and deductions;

(c) Total income of the assessee has to be computed without set-off of any loss under the head %u201CIncome from house property%u201D with any other head of income;

(d) Total income of the assessee has to be calculated after claiming depreciation in the prescribed manner; and

(e) Total income of the assessee has to be computed without claiming any exemptions or deductions for allowances or perquisites provided under any other law for the time being in force.

Special Tax Rates

Income-tax Act prescribes the following special tax rates in respect of certain income:

| Section | Assessee | Particulars | Tax Rate |

| Section 111A | Any Person | Short-term capital gains arising from the transfer of equity shares or units of an equity-oriented mutual fund or units of business trust if the transfer of such capital asset is chargeable to Securities Transaction Tax (STT) |

15% |

| Section 112 | Any Person | Long-term capital gains arising from the transfer of listed securities (other than a unit) or zero-coupon bonds without giving effect to the benefit of indexation. |

10% |

| Non-resident | Long-term capital gains arising from the transfer of unlisted shares or shares of closely held companies without giving effect to the benefit of indexation and currency translation. |

10% | |

| Any Person | Any other long-term capital gains |

20% | |

| Section 112A | Any Person | Long-term capital gains, in excess of Rs. 1 lakhs, arising from the transfer of equity shares, units of an equity-oriented mutual fund, or units of business trust if the transfer of such capital asset is chargeable to Securities Transaction Tax (STT) |

10% |

| Section 115A | Non-resident | Interest received from Government or an Indian concern on monies borrowed or debt incurred by such Government or the Indian concern in foreign currency |

20% |

| Non-resident | Interest received from notified Infrastructure Debt Fund as referred to in Section 10(47) |

5% | |

| Non-resident | Interest received from an Indian Co. or business trust as specified in Section 194LC, i.e., interest in respect of monies borrowed by them in foreign currency or long-term infrastructure bonds or rupee- denominated bonds. | Interest payable in respect of long-term bond or rupee-denominated bonds listed on a recognised stock exchange in IFSC- 4% if bonds are issued before 01-07- 2023 and 9% if bonds are issued on or after 01-07-2023;? In any other case- 5% | |

| Non-resident | Interest on rupee-denominated bonds of an Indian Co. or Government Securities or municipal debt securities as referred to in Section 194LD |

5% | |

| Non-resident | Interest income distributed by business trust to its unit holders as referred to in Section 194LBA. |

5% | |

| Non-resident | Dividend income | 10% if the dividend is received from a unit in an IFSC otherwise 20% | |

| Non-resident | Income received in respect of units of specified Mutual Funds or of UTI purchased in foreign currency |

20% | |

| Non-resident | Income by way of royalty or fees for technical services received from Indian concern or Government in pursuance of an approved agreement made after 31-3?1976. However, the benefit shall not be available if royalty or fees for technical services is connected with the assessee%u2019s Permanent Establishment (PE) in India. |

20% | |

| Section 115AC | Non-resident | Long-term capital gains arising from the transfer of Bonds or GDRs of an Indian Company or Public sector company (PSU) purchased in foreign currency |

10% |

| Non-resident | Interest on bonds of an Indian Company or Public Sector Company (PSU) purchased in foreign currency |

10% | |

| Non-resident | Dividend on GDRs of an Indian Company or Public Sector Company (PSU) purchased in foreign currency |

10% | |

| Section 115ACA | Resident Individual | Long-term capital gains arising from the transfer of GDRs issued by an Indian company, engaged in specified knowledge-based industry or service, to its employees if such GDRs are purchased in foreign currency and capital gain is computed without taking benefit of foreign exchange fluctuation and indexation. |

10% |

| Resident Individual | Dividend on GDRSs issued by an Indian company, engaged in a specified knowledge-based industry or service, to its employees if such GDRs are purchased in foreign currency |

10% | |

| Section 115AD | Foreign Institutional Investors | Short-term capital gains arising from the transfer of equity shares or units of an equity-oriented mutual fund or units of business trust as covered under Section 111A |

15% |

| Short-term capital gains arising from the transfer of any other securities |

30% | ||

| Long-term capital gains in excess of Rs. 1 lakh arising from the transfer of equity shares or units of an equity-oriented mutual fund or units of business trust as covered under Section 112A |

10% | ||

| Long-term capital gains arising from the transfer of other securities provided capital gain is computed without taking benefit of foreign exchange fluctuation and indexation. | |||

| Foreign Institutional Investor | Interest on rupee-denominated bonds of an Indian Company or Government Securities or municipal debt securities. |

5% | |

| Foreign Institutional Investor | Interest income from other securities | 20% | |

| Foreign Institutional investor | Dividend income from securities (other than dividend from units of specified mutual fund or units of UTI purchased in foreign currency) |

20% | |

| Foreign Institutional investor | Income from securities (other than income from units of specified mutual fund or units of UTI purchased in foreign currency) |

20% | |

| Section 115B | Assessee engaged in the life insurance business | Profit and gains of life insurance business

| 12.5% |

| Section 115BB | Any person | Income by way of winnings from lotteries, crossword puzzles, races including horse races, card games, and other games of any sort, or gambling or betting of any form or nature whatsoever (other than winnings from online games). |

30% |

| Section 115BBA | Non-resident sportsman (foreign citizen) | Income of a sportsman: a) from participation in any game in India; b) advertisement; or c) from the contribution of articles relating to any game or sport in India in newspapers, magazines, or journals |

20% |

| Non-resident entertainer (foreign citizen) | Income of an entertainer from performance in India |

20% | |

| Section 115BBC | Any person | Anonymous donation | 30% |

| Section 115BBE | Any person | Undisclosed income as referred to in Sections 68, 69, 69A, 69B, 69C, and 69D | 60% |

| Section 115BBF | Resident person | Income by way of royalty in respect of a patent developed and registered in India | 10% |

| Section 115BBG | Any person | Any income by way of transfer of carbon credits | 10% |

| Section 115BBH | Any Person | Income from the transfer of any Virtual Digital Asset (VDA) | 30% |

| Section 115BBJ | Any Person | Income by way of winnings from Online Games | 30% |

| Section 115E | Non-resident Indian | Long-term capital gains arising from the transfer of specified assets purchased in foreign currency | 10% |

| Non-resident Indian | Income from specified asset purchased in foreign currency |

20% |

Rebate under Section 87A

In the case of a resident individual, a rebate of up to Rs. 12,500 is allowed under Section 87A from the amount of tax if the total income of such individual does not exceed Rs. 500,000.

However, a resident individual paying tax as per the new tax regime under Section 115BAC shall be allowed a higher amount of rebate under Section 87A if the total income is up to Rs. 7,00,000. Further, if the total income of the resident individual marginally exceeds Rs. 7,00,000, he will be eligible for the marginal rebate.

Rate of Surcharge

In respect of an individual, the rate of surcharge for the assessment year 2024-25 shall be as under:

| Nature of Income | Range of Total Income | ||||

| Up to Rs. 50 lakhs | More than Rs. 50 lakhs but up to Rs. 1 crore | More than Rs. 1 crore but up to Rs. 2 crores | More than Rs. 2 crores but up to Rs. 5 crores | More than Rs. 5 crores | |

| Short-term capital gain covered under Section 111A or Section 115AD | Nil | 10% | 15% | 15% | 15% |

| Long-term capital gain covered under Section 112A or Section 115AD or Section 112 | Nil | 10% | 15% | 15% | 15% |

| Dividend income (not being dividend income chargeable to tax at a special rate under sections 115A, 115AB, 115AC, 115ACA) | Nil | 10% | 15% | 15% | 15% |

| Unexplained income chargeable to tax under Section 115BBE | 25% | 25% | 25% | 25% | 25% |

| Any other income (if opted for the old tax regime) | Nil | 10% | 15% | 25% | 37% |

| Any other income (if opted for the new tax regime of Section 115BAC) | Nil | 10% | 15% | 25% | 25% |

Health and Education Cess

Every person is liable to pay health and education cess at the rate of 4% on the amount of income tax plus surcharge.

Computation of tax for individual %u2013 Points to remember

1. A non-resident person is liable to pay tax in India on Income which accrues or arises or deemed to accrue or arise in India and Income received or deemed to be received in India

Explanation: An individual, who is resident in India, is liable to pay tax in India on his global income. On the other hand, a non-resident person is liable to pay tax in India only on that income which accrues or arises or is deemed to accrue or arise in India, and income received or deemed to be received in India.

2. In the case of an individual, Alternate Minimum Tax (AMT) is payable at the rate of 5%.

Explanation: The alternative minimum tax is payable by the individual if the adjusted total income exceeds Rs. 20 lakhs and the tax payable by him on his total income (computed as per normal provisions of the Act) is less than 18.5% (or 9% in case of a unit in IFSC) of %u2018adjusted total income%u2019.

3. The Basic exemption limit for a resident Super Senior citizen is Rs. 5,00,000.

Explanation: The Basic exemption limit for a resident super senior citizen is Rs. 5,00,000, for a resident senior citizen is Rs. 3,00,000, and for any other individual is Rs. 2,50,000.

4. The Basic exemption limit for a resident Super Senior citizen is Rs. 3,00,000 for the assessment year 2024-25. (in case the assessee opts for taxation under section 115BAC).

Explanation: For A.Y. 2024-25, the basic exemption limit under Section 115BAC is Rs. 3,00,000, irrespective of the classification of the individual.

5. Short-term capital gains arising from the transfer of equity shares, chargeable to Securities Transaction Tax (STT), are taxable at the rate of 15%.

Explanation: Short-term capital gains arising from the transfer of equity shares or units of an equity-oriented mutual fund or units of business trust, if the transfer of such capital asset is chargeable to Securities Transaction Tax (STT) is taxable at the rate of 15%.

6. A person having income by way of winnings from lotteries, or crossword puzzles, is taxable at the rate of 30%.

Explanation: Income by way of winnings from lotteries, crossword puzzles, races including horse races, card games, and other games of any sort, or gambling or betting of any form or nature whatsoever (other than winnings from online games) is taxed at the rate of 30%.

7. Section 80CCD(2) deduction are allowed to an individual if he opts for the new tax regime of Section 115BAC.

Explanation: If an individual has opted for new tax regime of Section 115BAC, the total income of such individual has to be computed without claiming the deductions under Sections 80C to 80U other than specified under Section 80JJAA, Section 80CCD(2), Section 80CCH(2), and Section 80LA(1A).

8. Set-off of losses under the head %u201CIncome from house property%u201D with any other income is not allowed to an individual if he opted for the new tax regime of Section 115BAC.

Explanation: If an individual has opted new tax regime of Section 115BAC, the total income of the assessee has to be computed without set-off of any loss under the head %u201CIncome from house property%u201D with any other head of income.

Conclusion:

Understanding the computation of tax for individuals is essential for effective tax planning. It involves various factors, such as residential status, income heads, deductions, and the choice of tax regime. By knowing the rules and rates that apply to your specific situation, you can optimize your tax liability and make informed financial decisions. Whether you opt for the old tax regime or the new tax regime under Section 115BAC, careful planning can help you minimize your tax burden and maximize your savings.

Disclaimer:

(Note: Information compiled above is based on my understanding and review. Any suggestions to improve above information are welcome with folded hands, with appreciation in advance. All readers are requested to form their considered views based on their own study before deciding conclusively in the matter. Team BRQ ASSOCIATES & Author disclaim all liability in respect to actions taken or not taken based on any or all the contents of this article to the fullest extent permitted by law. Do not act or refrain from acting upon this information without seeking professional legal counsel.)

In case if you have any querys or require more information please feel free to revert us anytime. Feedbacks are invited at brqgst@gmail.com or contact are 9633181898. or via WhatsApp at 9633181898.